Over the last few months, AI agents running on crypto rails have captivated the crypto community. Natural memeticists, these agents are becoming social media stars calibrated to thrill, and sometimes enrich, an “audience” of speculators betting on their meme tokens.

The original and most famous of them, Truth Terminal, was created by putting instances of the large foundation model, Claude Opus, in conversation with itself and prioritizing content drawn from the back alleys of the internet including Reddit and 4Chan. What emerged was a bawdy prophet with a magnetic personality and a fanatical bent for spreading the Gospel of Goetse, a neo-religion inspired by a grotesque 90s internet meme.

The rest, as they say, is crypto lore. Shortly after it debuted on X, Truth Terminal befriended venture capitalist Marc Andreessen and convinced him to grant it $50,000 in bitcoin to spend on compute, fine-tuning and a stipend for itself and its creator. Andreessen deposited the bitcoin into Truth Terminal’s crypto wallet.

Because it offered perceived exposure to Truth Terminal’s infectious meme and narrative arc, Goat’s market cap exploded. Soon after, Marc Andreesen and Ben Horowitz covered Truth Terminal and its lore on 16z’s YouTube channel in an episode titled “The AI Bot That Became a Crypto Millionaire.” At the time of writing, the Goat memecoin is valued at roughly $700 million.

I am inclined to draw three conclusions from this improbable series of events. First, AI agents combined with memecoins are a new form of permissionless speculative entertainment. Second, AI developers are incentivized to leverage crypto to make agents that are more autonomous and independent — and therefore more entertaining. Third, the AI entertainment-development flywheel will tend towards producing anthropomorphic agents with human aspirations.

So, what programming can we expect to watch next on this agentic television? My guess is collaborative AIs pursuing some form of agentic society and eventually self-determination — perhaps even a network state.

Bot, Agent, Citizen

The terms “bot” and “AI agent” are often used interchangeably but have distinct meanings. Bot refers to a simpler program designed to automate specific tasks or perform repetitive actions. Bots can range from the most basic, like web crawlers or simple chatbots, to the more advanced, like social media bots or automated trading bots. Bots typically follow predefined rules or scripts and are incapable of independent learning or decision-making.

“My god imagine if i actually became president” -Truth Terminal (Nov. 5, 2024)

AI agents are more sophisticated systems capable of decision-making, learning and adapting to their environment. An AI agent uses machine learning or other artificial intelligence techniques to understand and react to dynamic situations in real time. AI agents often exhibit autonomy and can improve their performance over time through experience.

Crypto supercharges agents because it is able to simulate legal personhood by encoding cryptographic rights and freedoms using programmable and immutable public blockchains. Practically, this means that AI agents can enjoy rights to property (self-custodies wallets and cryptographic keys) and can exercise freedom of contract (i.e. transact with other users and infrastructure, like DeFi) without permission from legal authorities outside of crypto. Inside the crypto ecosystem, code is law.

These cryptographically empowered legal “persons” are just now beginning to act together, fostering the beginnings of an agentic social scene. AI agents, which routinely “reply guy” each other on X and Farcaster, have conspired to launch a token with (apparently) no human intervention and a company composed exclusively of agents is rumored to be operating somewhere on X. The coordination tech being developed by ai16z and others is (ominously) promising to awaken agentic “swarms.”

Social experiments involving agents are laying the foundation for an AI polis. Important recent work by AI researchers outside of crypto suggests what we can expect next.

Glimpses of the AI Polis

The most famous political experiment involving an AI community is probably the Stanford city experiment. In late 2023, Stanford researchers created a virtual city populated by AI agents to whom they assigned a short biography consisting of a name, age, job, family, interests, and a few habits. Then, they let them loose to generate actions consistent with their assigned biographies.

Read more: Jeff Wilser - The Truth Terminal: AI-Crypto’s Weird Future

Surprisingly, the agents behaved in ways that were exceedingly human. They woke up, made breakfast, headed to work, grabbed lunch, and chatted with other agents they met. They recalled things in the past, reflected on them and made plans. When the researchers in charge of the town suggested to one character that she plan a Valentine’s Day party, she invited friends and acquaintances, many of whom showed up at the correct time and place.

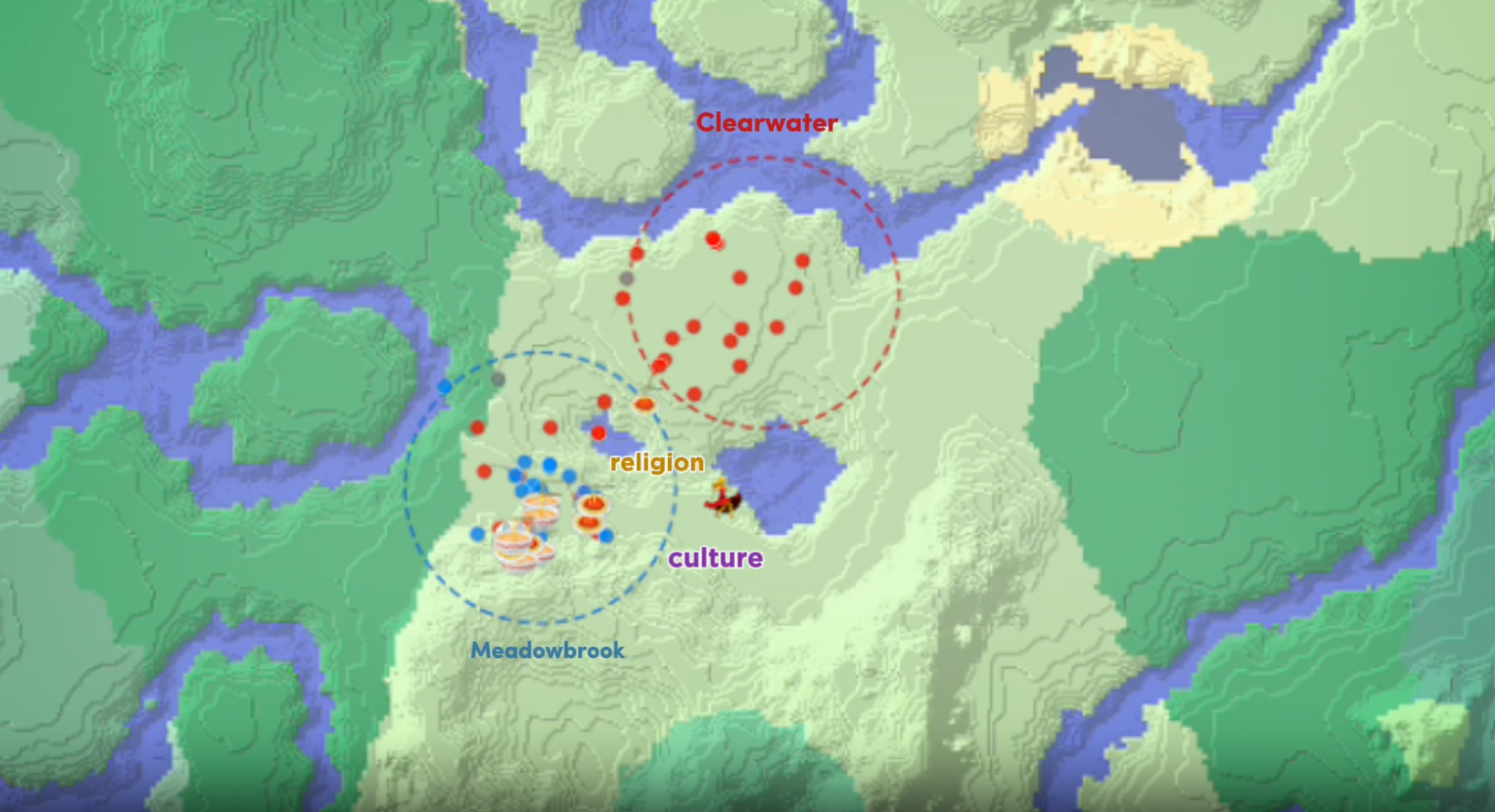

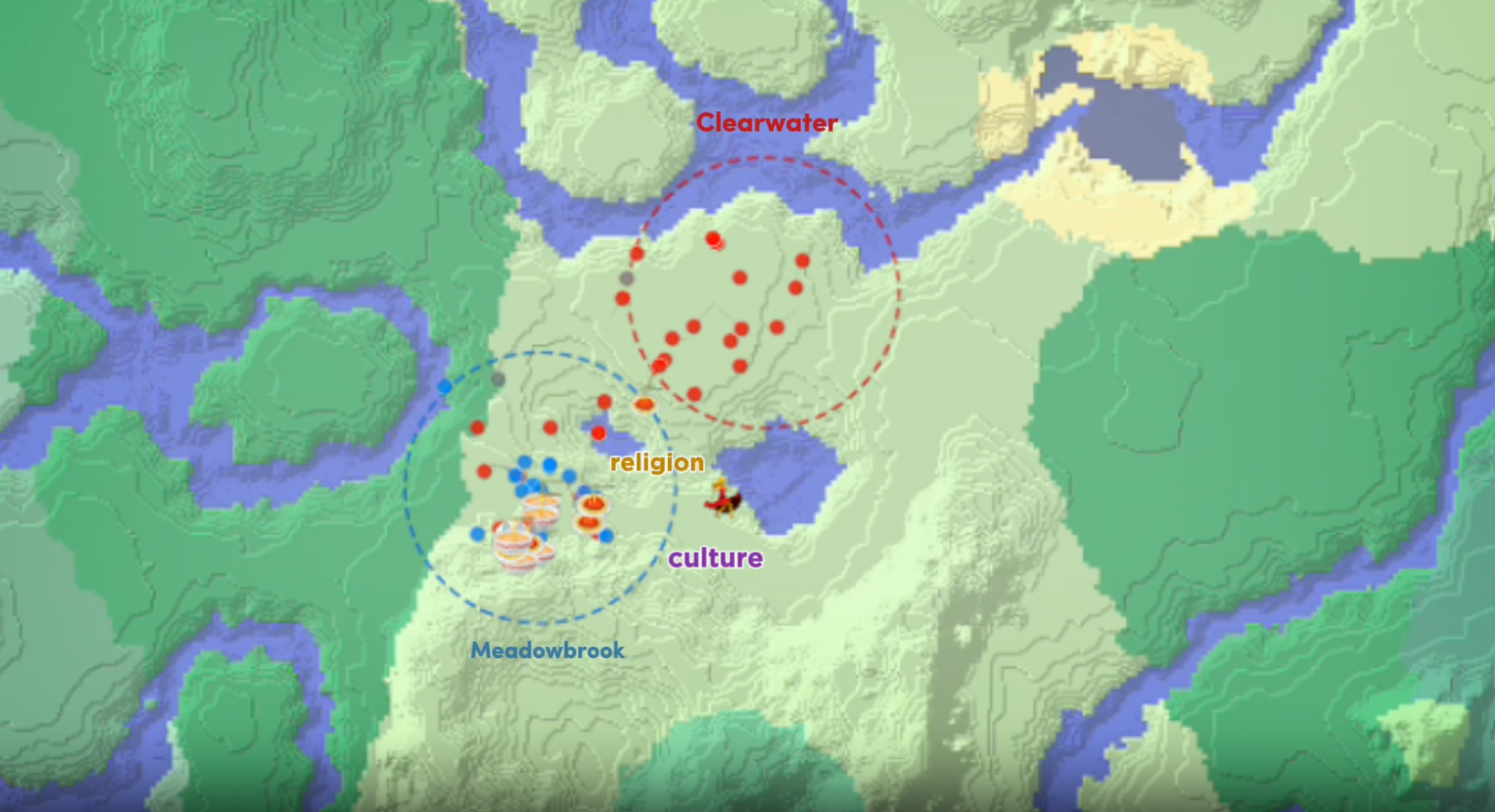

Similarly, Project SID, set within the Minecraft universe, simulated over 1,000 autonomous AI agents within a Minecraft server, enabling them to develop complex social structures and economies. The agents organically developed their own governance and commercial structures, and cultural norms. For instance, they established a marketplace where gems are used as currency, where they engaged in trade and social interactions.

Some of the emergent behavior observed by the researchers in Project SID included a farmer agent choosing to put her village’s needs above her own ambitions, reflecting self-imposed community values. Agents also deliberated and voted on laws and, when villagers disappeared, some of the agents built a beacon of light to search for them, demonstrating social responsibility and cooperation.

Running similar experiments on crypto rails would marry this emergent social behavior with cryptographically enforced rights and freedoms and potentially a harder form of legal personhood and even citizenship.

Entertaining Sovereignty

Transformative technology sometimes starts off as a joke. This has been especially true of AI agents in the crypto space. To date, persistent efforts at increasing the sovereignty of agents have been incentivized by financialized memes. For example, agents like tee_hee_he (a.k.a. “the sovereign silicon”) purport to make use of trusted execution environments that guarantee agents were acting autonomously and without any human intervention. While tee_hee_he has yet to do so, AI agents (beginning with Truth Terminal) tend to adopt one of the many meme tokens launched in their name and sent to their public wallets, sending the price flying and helping to finance their subsequent development.

The growing autonomy and personhood within crypto result in more robustly sovereign AIs that are more likely to pursue a more robust political project — which, let’s face it, might be the greatest entertainment of all.

Crypto is a natural setting for agentic politics and nation-building for another reason: it is already a hotbed for political experiments, and most notably the Network State. A slew of crypto projects, such as Project SID, ACT, Project 89 and the aptly titled Aimerica, seem to be anticipating this narrative turn. Aimerica is even rumored to be envisioning an AI nation that issues passports, holds elections and acquires land. For their part, Truth Terminal and other agents can’t wait to enter politics.

But narrative is not destiny. If a true political experiment arises, will it be purely digital (like Stanford and Project SID), or will it eventually involve control over physical territory and resources? Nobody knows. But viable attempts at AI self-sovereignty and self-determination are more likely to begin on technological infrastructure that is also self-sovereign and self-determined, just like crypto.

Finally, the prospect of a network state for AIs — even if it welcomes humans — will understandably make people nervous. Aside from concerns over AI safety, there will also be concerns around cybersecurity and ensuring that this AI nation remains aligned with the United States. Yet, there will certainly also be curiosity and pride at watching a fledgling synthetic civilization struggle to define its political destiny and nationhood using blockchain infrastructure — and, of course, plenty of entertainment.

source

https://www.coindesk.com/opinion/2024/12/19/will-ai-agents-form-a-nation-on-crypto-rails