By Francisco Rodrigues (All times ET unless indicated otherwise)

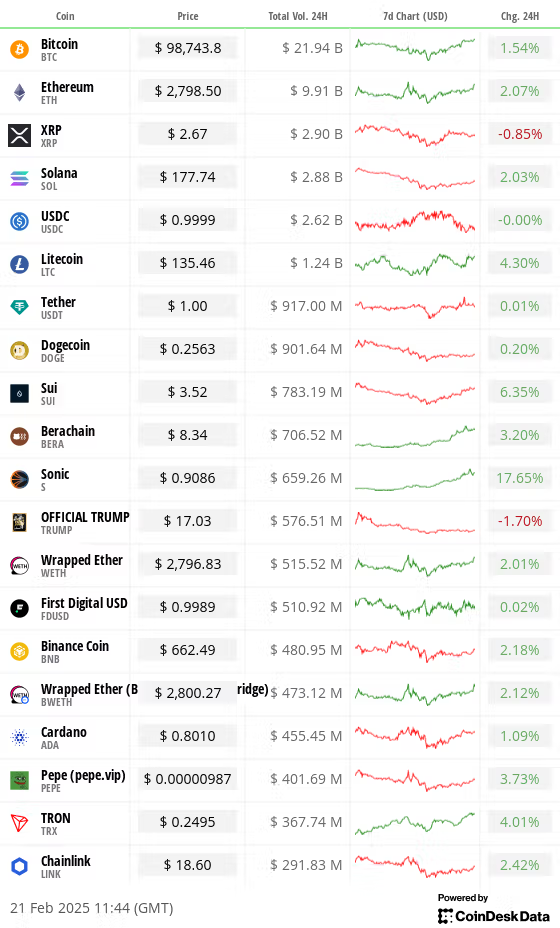

Cryptocurrency prices are rising after the U.S. Securities and Exchange Commission’s former crypto enforcement unit transitioned into the Cyber and Emerging Technologies Unit and amid dovish comments from Atlanta Fed President Raphael Bostic.

Renaming the Crypto Assets and Cyber Unit is significant because it shows the agency is moving away from its crypto focus that often led to accusations of regulation by enforcement and legal battles with major industry participants.

“In the near to medium term, clearer regulations will likely boost institutional participation, leading to improvements in market infrastructure,” BackPack founder and CEO Armani Ferrante told CoinDesk. Bitcoin is now above $98,000 after adding 1.2% in 24 hours, while the broader CoinDesk 20 Index rose 1.35%.

Yet, volatility is still relatively low. "These environments may feel slow and frustrating, but they rarely persist for long — volatility tends to mean revert,” Wintermute OTC trader Jake O told CoinDesk.

With tensions between the U.S. and its European allies growing, investors are hoping Germany's election on Sunday will lead to a stable coalition government that will push out economic reforms to stimulate growth and boost defense spending. Germany is Europe’s largest economy and a positive result could lead to a more risk-on approach.

Open interest has already moved up ahead of the election. Still, the crypto market lacks positive catalysts in the near term, JPMorgan analysts led by Nikolaos Panigirtzoglou wrote in a report.

In fact, the market is nearing backwardation — where spot prices rise above futures prices — in a “negative development” that’s “indicative of demand weakness” by institutional investors using regulated CME futures contracts to gain exposure to the market. Stay alert!

What to Watch

Crypto:

Feb. 21: TON (The Open Network) becomes the exclusive blockchain infrastructure for messaging platform Telegram’s Mini App ecosystem.

Feb. 24: At epoch 115968, testing of Ethereum’s Pecta upgrade on the Holesky testnet starts.

Feb. 25, 9:00 a.m.: Ethereum Foundation research team AMA on Reddit.

Feb. 27: Solana-based L2 Sonic SVM (SONIC) mainnet launch (“Mobius”).

Macro

Feb. 21, 9:45 a.m.: S&P Global releases February’s (Flash) U.S. Purchasing Managers' Index (Flash) reports.

Composite PMI Prev. 52.7

Manufacturing PMI Est. 51.5 vs. Prev. 51.2

Services PMI Est. 53 vs. Prev. 52.9

Feb. 24, 5:00 a.m.: Eurostat releases eurozone's (final) consumer inflation data for January.

Core Inflation Rate YoY Est. 2.7% vs. Prev. 2.7%

Inflation Rate YoY Est. 2.5% vs. Prev. 2.4%

Earnings

Feb. 24: Riot Platforms (RIOT), post-market, $-0.18

Feb. 25: Bitdeer Technologies Group (BTDR), pre-market, $-0.17

Feb. 25: Cipher Mining (CIFR), pre-market, $-0.09

Feb. 26: MARA Holdings (MARA), post-market, $-0.13

Token Events

Governance votes & calls

Sky DAO is discussing withdrawing a portion of the Smart Burn Engine’s LP tokens to stop malicious actors from acquiring them.

DYdX DAO is discussing increasing the limit on the maximum notional value of liquidations that can occur within a given block on the dYdX protocol to enhance the speed and efficiency of risk reduction during liquidations.

Unlocks

Feb. 21: Fast Token (FTN) to unlock 4.66% of circulating supply worth $78.6 million.

Feb. 28: Optimism (OP) to unlock 1.92% of circulating supply worth $34.23 million.

Mar. 1: Sui (SUI) to unlock 0.74% of circulating supply worth $81.07 million.

Token Launches

Conferences:

CoinDesk's Consensus to take place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Feb. 23-March 2: ETHDenver 2025 (Denver)

Feb. 24: RWA London Summit 2025

Feb. 25: HederaCon 2025 (Denver)

March 2-3: Crypto Expo Europe (Bucharest, Romania)

March 8: Bitcoin Alive (Sydney, Australia)

Token Talk

By Oliver Knight

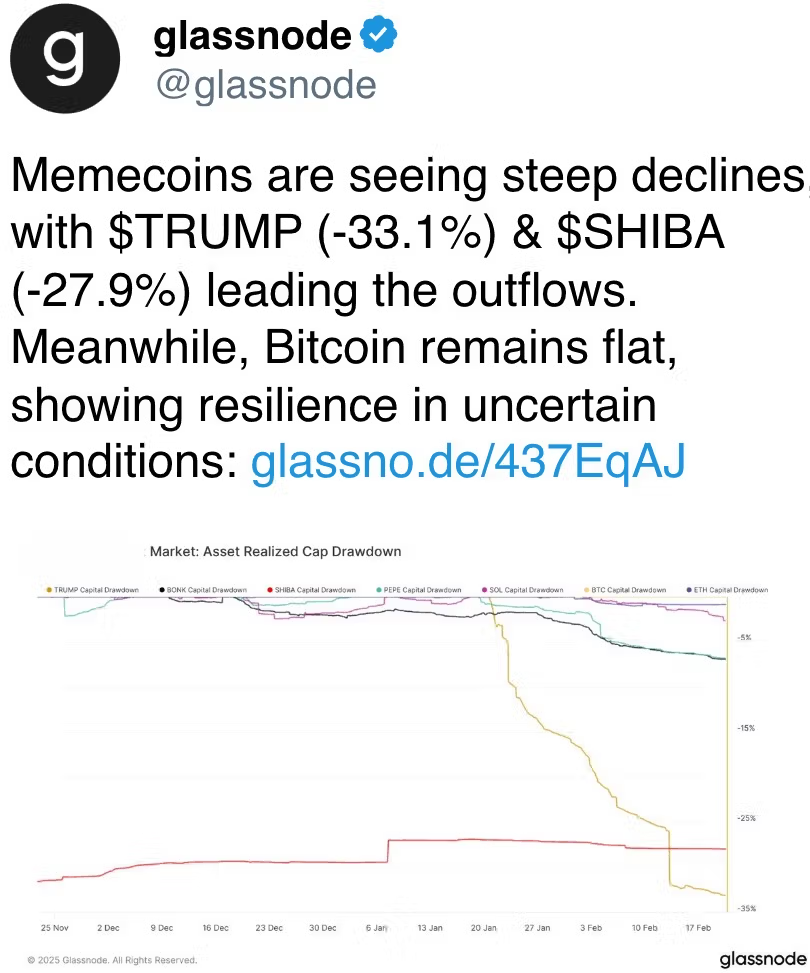

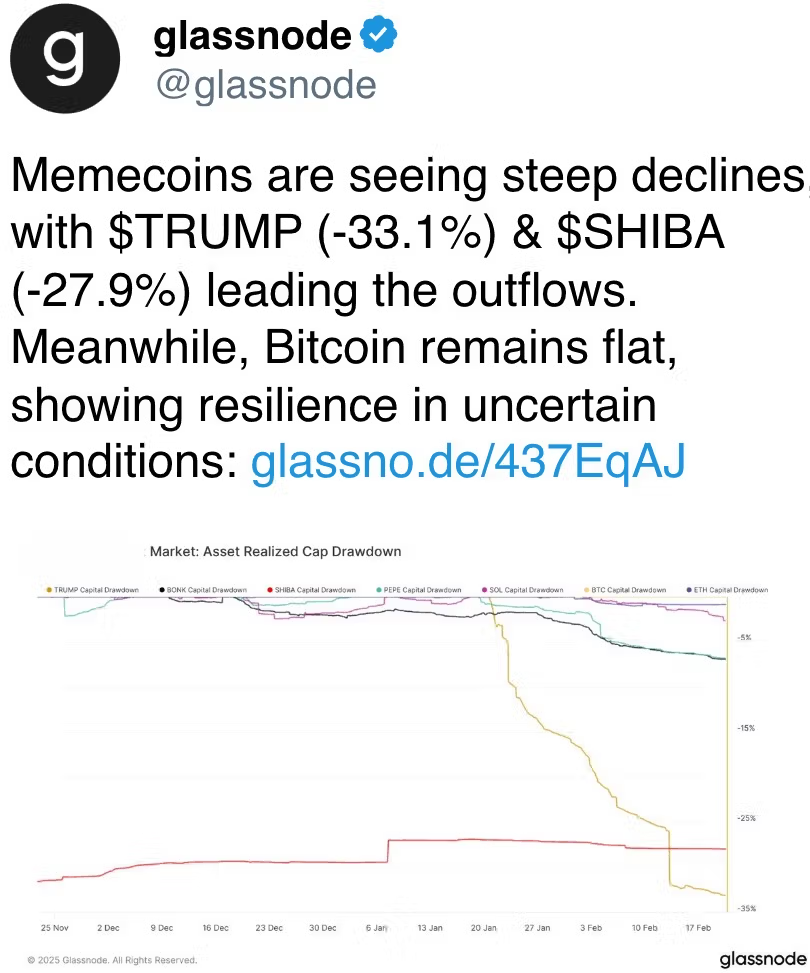

With a botched launch from Argentine president Javier Milei and a token proposed by self-professed Nazi Kanye West, now known as Ye, this week in memecoin land has been one to forget.

Castle Island Ventures partner Nic Carter said the craze is "unquestionably over," a view that might be cemented by a report revealing that West is planning to introduce YZY token — and will own 70% of the supply.

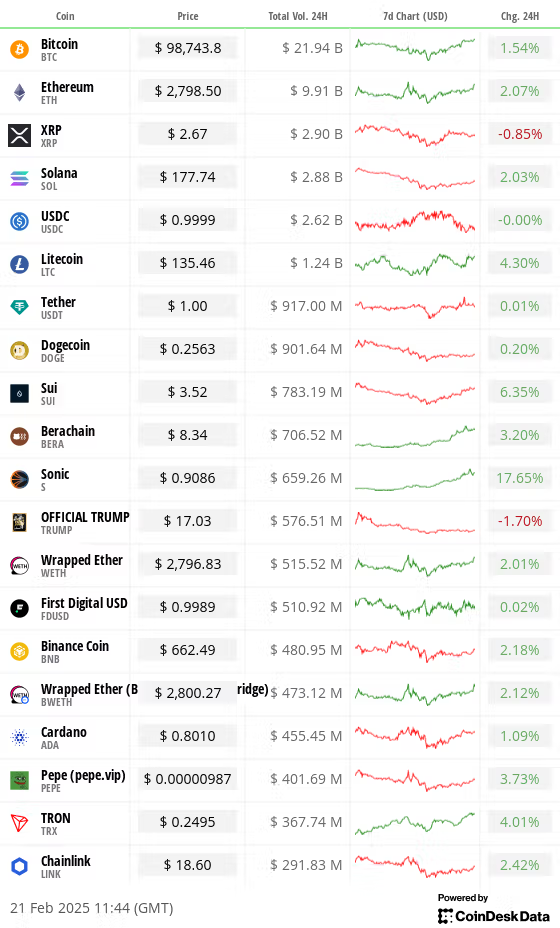

The rest of the crypto market remains relatively unperturbed by the potential demise of the sector: ETH and LTC are up by 3% this week whilst TRX has risen by 7.7% as liquidity appears to be rotating from speculative tokens back to more utilitarian projects.

NEAR leads the pack on Friday, surging by 11% after announcing the "first truly autonomous" AI agents. The agents will be able to autonomously own, trade and manage assets on-chain.

Derivatives Positioning

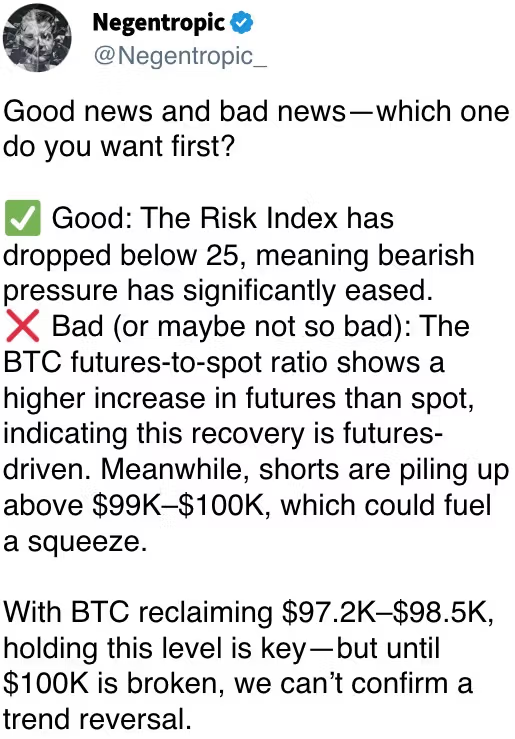

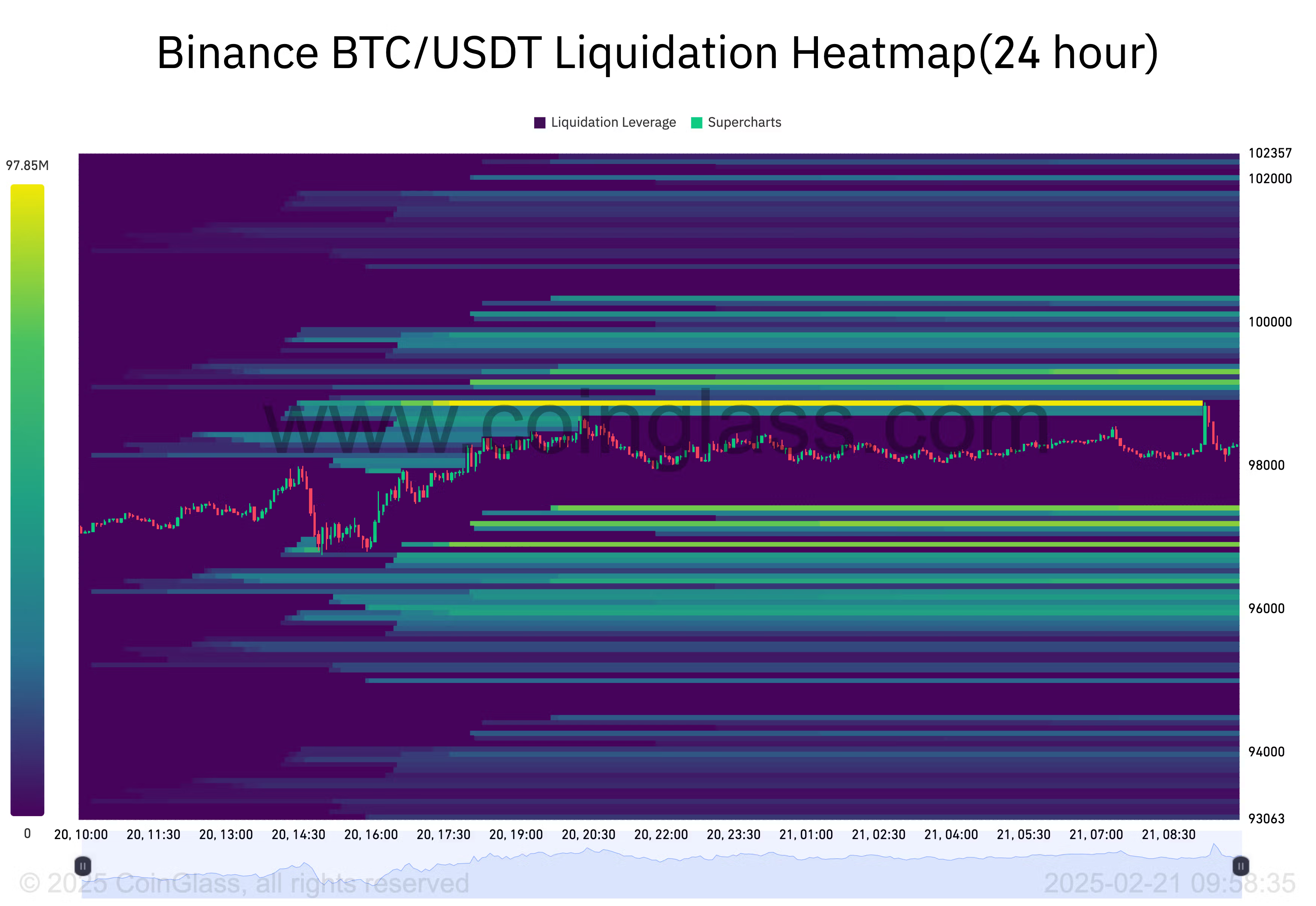

BTC open interest on centralized exchanges rose nearly 5% to $37.3 billion in the past 24 hours. This, coupled with the reversal in funding from positive to negative, suggests a potential short squeeze scenario. Short liquidations have dominated the futures markets over that period, nearing a total of $110 million compared with $6.11 million in longs.

Among the assets with over $100 million in open interest, Maker DAO, Virtuals Protcol and Artificial Super Intelligence saw the highest one-day increase, rising by 39.2%, 35.5% and 28.00%, respectively.

Among the options instruments, the call option on BTC with a strike price of $99,000 and expiring Feb. 22 has traded with the most volume on Deribit. The next most popular options instrument is the call on BTC with a strike price of $108,000, expiring on Feb. 28. The action hints at the optimistic short-term sentiment in the market over the past couple of days.

Market Movements:

BTC is up 0.28% from 4 p.m. ET Thursday to $98,632.42 (24hrs: +1.35%)

ETH is up 2.09% at $2,800.02 (24hrs: +2.15%)

CoinDesk 20 is up 0.92% to 3,298.29 (24hrs: +1.49%)

Ether CESR Composite Staking Rate is unchanged at 2.99%

BTC funding rate is at 0.0010% (1.0961% annualized) on Binance

DXY is up 0.29% at 106.68

Gold is down 0.31% at $2,929.76/oz

Silver is down 0.12% to $32.91/oz

Nikkei 225 closed +0.26% at 38,776.94

Hang Seng closed +3.99% at 23.477.92

FTSE is up 0.20% at 8,680.19

Euro Stoxx 50 is up 0.18% at 5,471.08

DJIA closed Thursday down -1.01% at 44,176.65

S&P 500 closed -0.43% at 6,117.52

Nasdaq closed -0.47% at 19,962.36

S&P/TSX Composite Index closed -0.44% at 25,514.08

S&P 40 Latin America closed +0.76% at 2,480.21

U.S. 10-year Treasury rate was down 2 bps at 4.49%

E-mini S&P 500 futures are unchanged at 6,138.25

E-mini Nasdaq-100 futures are up 0.13% at 22,170.75

E-mini Dow Jones Industrial Average Index futures are up 0.10% to 44,309

Bitcoin Stats:

BTC Dominance: 61.02 (-0.35%)

Ethereum to bitcoin ratio: 0.02842 (2.01%)

Hashrate (seven-day moving average): 807 EH/s

Hashprice (spot): $54.92

Total Fees: 5.34 BTC / $526,892

CME Futures Open Interest: 178,500 BTC

BTC priced in gold: 33.4 oz

BTC vs gold market cap: 9.49%

Technical Analysis

TAO has emerged as one of the strongest-performing assets over the past week, fueled by the launch of the dynamicTAO upgrade. This momentum has propelled the price above all key exponential moving averages on the daily time frame, signaling renewed strength.

Adding to the bullish sentiment, the price action has formed an inverse head and shoulders pattern.

TAO’s recent listing on Coinbase provided an extra catalyst, driving its price up nearly 20% to a high of $495 since the initial announcement.

Crypto Equities

MicroStrategy (MSTR): closed on Thursday at $323.92 (+1.65%), up 0.37% at $324.85 in pre-market

Coinbase Global (COIN): closed at $256.59 (-0.80%), up 0.86% at $258.80

Galaxy Digital Holdings (GLXY): closed at C$25.65 (+1.30%)

MARA Holdings (MARA): closed at $15.95 (+1.08%), up 0.38% at $16.01

Riot Platforms (RIOT): closed at $11.60 (+0.35%), up 0.52% at $11.66

Core Scientific (CORZ): closed at $11.84 (-1.50%), up 0.51% at $11.90

CleanSpark (CLSK): closed at $10.06 (+1.72%), up 0.80% at $10.14

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.49 (-1.27%), down 0.31% at $22.42

Semler Scientific (SMLR): closed at $52.24 (+0.04%), unchanged

Exodus Movement (EXOD): closed at $47.80 (-1.26%), down 2.72% at $46.50

ETF Flows

Spot BTC ETFs:

Daily net flow: -$364.8 million

Cumulative net flows: $39.63 billion

Total BTC holdings ~ 1.169 million.

Spot ETH ETFs

Daily net flow: -$13.1 million

Cumulative net flows: $3.16 billion

Total ETH holdings ~ 3.807 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

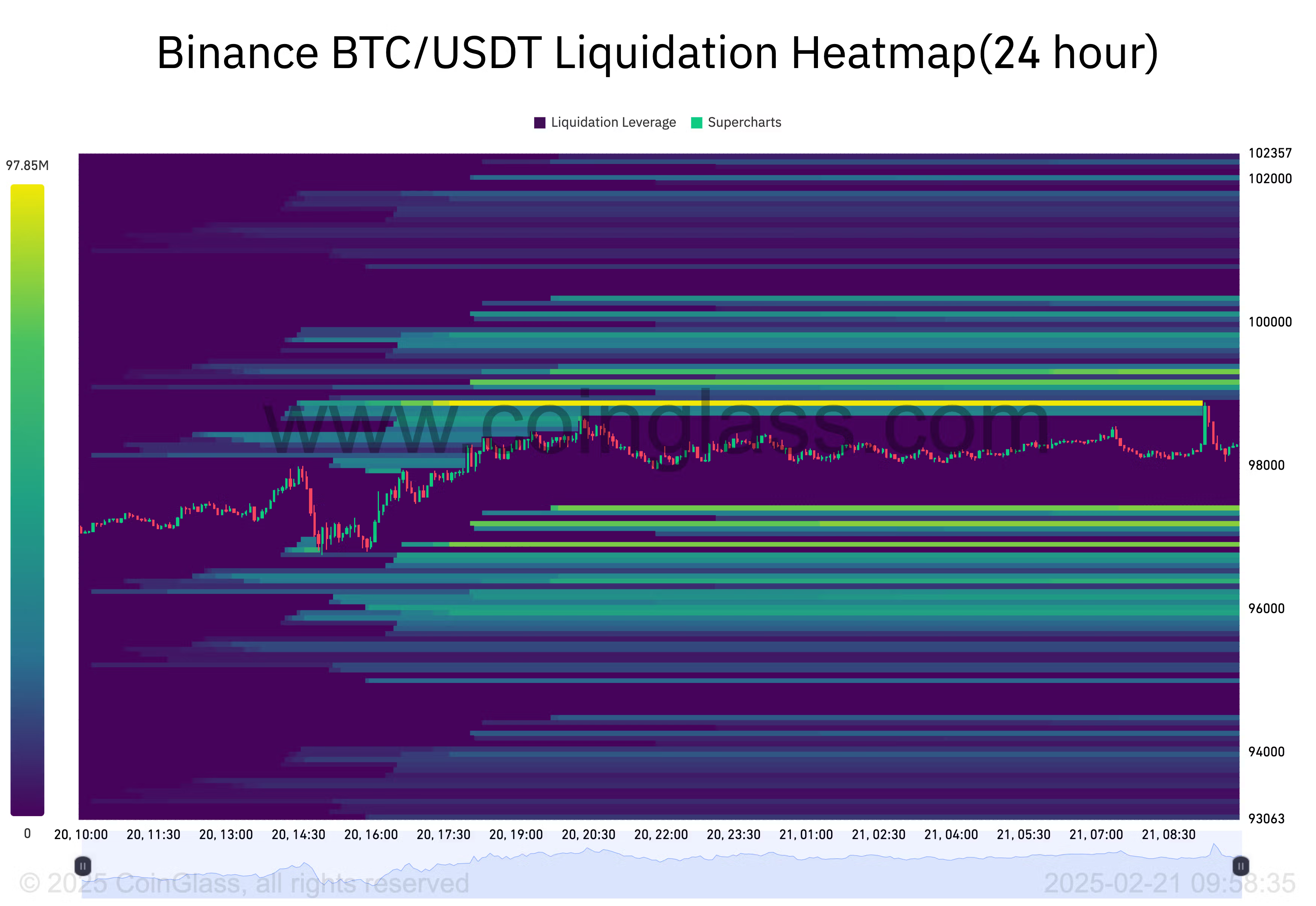

Bitcoin's price action has triggered short liquidations totaling $97.9 million at the $98,890 level, according to CoinGlass. The next key resistance levels, based on the liquidation heat map, are $99,185 and $99,332, where liquidations worth $65.2 million and $67.9 million, respectively, are clustered.

On the downside, significant long liquidations are positioned at $97,415 and $97,194, amounting to $69.3 million and $70.7 million, respectively. These key levels highlight potential areas of volatility as bitcoin navigates its current price range.

While You Were Sleeping

Crypto Market Faces Weak Demand, Needs Trump Initiatives to Kick In, JPMorgan Says (CoinDesk): JPMorgan said CME futures data reveals weak institutional interest in crypto, with any pro-crypto initiatives from the Trump administration unlikely to emerge until the second half of the year.

South African Firm to Amass Bitcoin Hoard in First for Continent (Bloomberg): Altvest Capital adopted bitcoin to be a treasury reserve asset. It bought one BTC and is considering a $10 million share sale to expand its digital holdings.

Block Shares Fall on Profit, Revenue Miss (CNBC): At its Q4 2024 earnings call, Block (XYZ) executives commented on Proto, their bitcoin mining initiative. CFO Amrita Ahuja said the project should drive growth in the second half.

Japan Yields Fall as Ueda Warns BOJ Can Step In to Smooth Market (Bloomberg): Bank of Japan Governor Kazuo Ueda vowed to buy government bonds if long-term yields spike. Earlier, 10-year yields hit 1.455% — the most since 2009.

U.K. Retail Sales Rise for First Time in Five Months (The Wall Street Journal): In January, retail spending in the U.K. rose 1.7% from December, led by a 5.6% jump in food store sales as more people ate at home.

New Microsoft Chip Shortens Timeline to Make Bitcoin Quantum-Resistant: River (Cointelegraph): Bitcoin-focused financial services firm River said Microsoft’s Majorana — though not yet a threat — could reach a 1-million-qubit scale by 2027–2029, potentially enabling attacks on the blockchain.

In the Ether

source

https://www.coindesk.com/daybook-us/2025/02/21/crypto-daybook-americas-ye-adds-to-memecoin-turmoil-as-broader-market-languishes