Earlier this month, the Department of Justice disbanded its National Cryptocurrency Enforcement Team and said it would no longer pursue what Deputy Attorney General Todd Blanche described as "regulation by prosecution."

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

'Regulation by prosecution'

The narrative

The U.S. Department of Justice "will no longer pursue litigation or enforcement actions that have the effect of superimposing regulatory frameworks on digital assets" in lieu of regulatory agencies putting together their own frameworks for overseeing the sector, a 4-page memo signed by Deputy Attorney General Todd Blanche on April 7 said. In other words, the DOJ will no longer pursue "regulation by prosecution," the memo said.

Why it matters

The DOJ's memo raised concerns that it may mean criminal activities in the crypto sector would not be prosecuted, or at least prosecuted as heavily as it was under the past several years — both by disbanding the National Cryptocurrency Enforcement Team (NCET) and by shifting the entity's priorities.

Breaking it down

At a practical level, the memo itself is internal guidance but may not be a binding document. Multiple attorneys told CoinDesk they interpreted the guidance to indicate that the DOJ would still bring fraud or other criminal cases involving crypto, but would try to avoid any cases where the DOJ itself had to determine if a digital asset was a security or a commodity.

"Fraud is still fraud," said Josh Naftalis, a partner at Pallas Partners LLP and a former prosecutor with the U.S. Attorney's office for the Southern District of New York. "This memo does not seem to say the DOJ is not going to prosecute fraud in the crypto space."

Still, the memo raised alarms for prominent Democrats who questioned whether the DOJ was suggesting it would let criminal conduct occur. Senators Elizabeth Warren, Mazie Hirono, Richard Durbin, Sheldon Whitehouse, Christopher Coons and Richard Blumenthal wrote a letter to Blanche, saying his "decision to give a free pass to cryptocurrency money launderers" and shut down the NCET were "grave mistakes that will support sanctions evasion, drug trafficking, scams and child sexual exploitation."

"Specifically, the Department will no longer target virtual currency exchanges, mixing and tumbling services and offline wallets for the acts of their end users or unwitting violations of regulations — except to the extent the investigation is consistent with the priorities articulated in the following paragraphs," the DOJ memo said, a passage the Senators' letter referenced.

New York Attorney General Letitia James wrote an open letter to Senate leaders in the same week asking them to advance legislation to address cryptocurrency risks. She did not specifically reference Blanche's memo but detailed possible ways to better police the sector through legislation.

Katherine Reilly, a partner at Pryor Cashman and a former prosecutor with the U.S. Attorney's Office for the Southern District of New York, told CoinDesk that most of the major crypto cases brought by the DOJ in recent years would not have been affected had this guidance been in effect.

The BitMEX case in 2020, when the DOJ and Commodity Futures Trading Commission brought unregistered trading and other charges against the platform, is "probably closest to the line" of being a case that may not have been brought under this guidance, she said.

Trump pardoned BitMEX, its founders and a senior employee in late March, barely two weeks before the DOJ memo was shared.

"I think that it's clear that the Justice Department wants to limit the DOJ's role in regulating the crypto industry … looking beyond its role in other crimes, fraud, laundering proceeds from narcotics trafficking, things like that, and sort of take a step back from the role of trying to bring order and fairness to the crypto industry as a whole," Reilly said.

That's "probably the intent behind the BitMEX pardons too," she said.

Naftalis said the DOJ will continue to pursue drug, terrorism or other illicit financing charges even under the memo.

"I think that the headline for the industry is to the extent that there are legal uses of crypto, they're not going to set the guard rail by criminal enforcement," he said. "That's for Congress."

One section of the memo tells prosecutors not to charge Bank Secrecy Act violations, unregistered securities offering violations, unregistered broker-dealer violations or other Commodity Exchange Act registration violations "unless there is evidence that the defendant knew of the licensing or registration requirement at issue and violated such a requirement willfully."

Carla Reyes, an Associate Professor of Law at SMU Dedman School of Law, told CoinDesk that this may be referencing recent cases where developers build tools under the impression that they were not committing unlicensed money transmitting activities under existing guidance but may get charged anyway.

"Most criminal statutes require some level of knowledge to define your intention, and knowledge that you're committing a crime when you do it," she said. "The further away you get from that, the lesser the charge, but the more willful [and] intentional it is, the higher the charge."

What the memo seems to want to explicitly move away from is any suggestion that federal prosecutors would interpret how securities or commodities laws might apply to digital assets.

"Prosecutors should not charge violations of the Securities Act of 1933, the Securities Exchange Act of 1934, the Commodity Exchange Act, or the regulations promulgated pursuant to these Acts, in cases where (a) the charge would require the Justice Department to litigate whether a digital asset is a 'security' or 'commodity,' and (b) there is an adequate alternative criminal charge available, such as mail or wire fraud," the memo said.

A popular critique leveled against former SEC Chair Gary Gensler by the crypto industry was that he was "regulating by enforcement," rather than focusing on developing guidance for the industry to know what was or wasn't acceptable. Blanche seems to be referring to a similar critique in the memo, Naftalis said, in that one-off enforcement decisions by the SEC or DOJ should not define the guardrails for the industry.

Steve Segal, a shareholder at Buchalter, said that some of the DOJ's past cases would charge trading venues for failing to police their own customers. The memo now seems to suggest that if a crypto exchange's executives were running a clean platform, and customers were laundering funds derived from criminal activities, the executives would not be charged. This is in contrast with, for example, FTX, where the executives were charged and convicted of (or pled guilty to) fraud charges.

"Of course, a lot of the big crypto cases we've seen over the last few years are sort of pure investor fraud, things like FTX. And one of the more interesting things about this memo is it talks about crypto investors and really prioritizing cases where crypto investors are being victimized," Reilly said. "And so I don't think we should conclude that this memo means we're going to see a lot fewer cases in the crypto space, or that crypto companies can sort of breathe a sigh of relief that the DOJ is out of the picture for a few years."

The DOJ's future cases may appear a bit different in terms of the specific allegations made, but "it's much too soon to say that everybody can assume the DOJ is out of the crypto business," she said.

Many of the attorneys speaking to CoinDesk agreed that the memo itself did not clarify all of the different issues that may come up with a criminal case, nor was it an end-all/be-all document.

The memo announced prosecutorial discretion but it isn't itself a law, Reyes said, adding that it may guide internal decision-making about which cases to pursue the most heavily, as well as the strategies that guide those prosecutions.

A lot of details about how this memo ties together with Trump's executive order on the strategic bitcoin reserve still need to be spelled out, Segal said. Sections on victim compensation and how seized funds should be handled in the memo do not explain how the DOJ might handle situations where seized funds are turned over to bankruptcy estates, such as what happened with FTX or other similar scenarios.

"I think we'll really have to see how it plays out, because this guidance, I do think, leaves prosecutors a lot of room to bring cases even of these kinds of violations that are being cast as more regulatory," Reilly said. "So even if that's the intent, I think the devil is in the details on what cases we see going forward."

Stories you may have missed

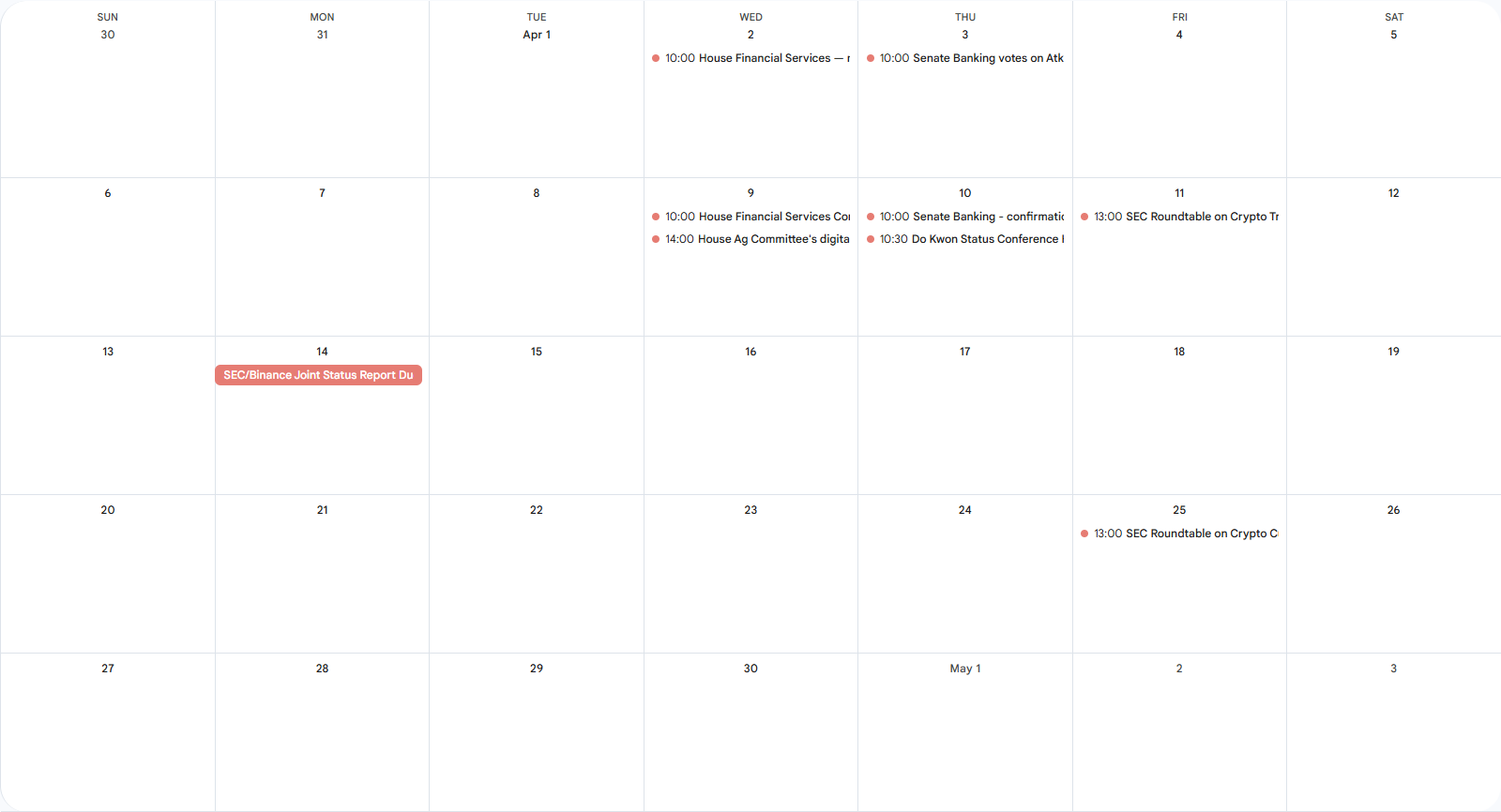

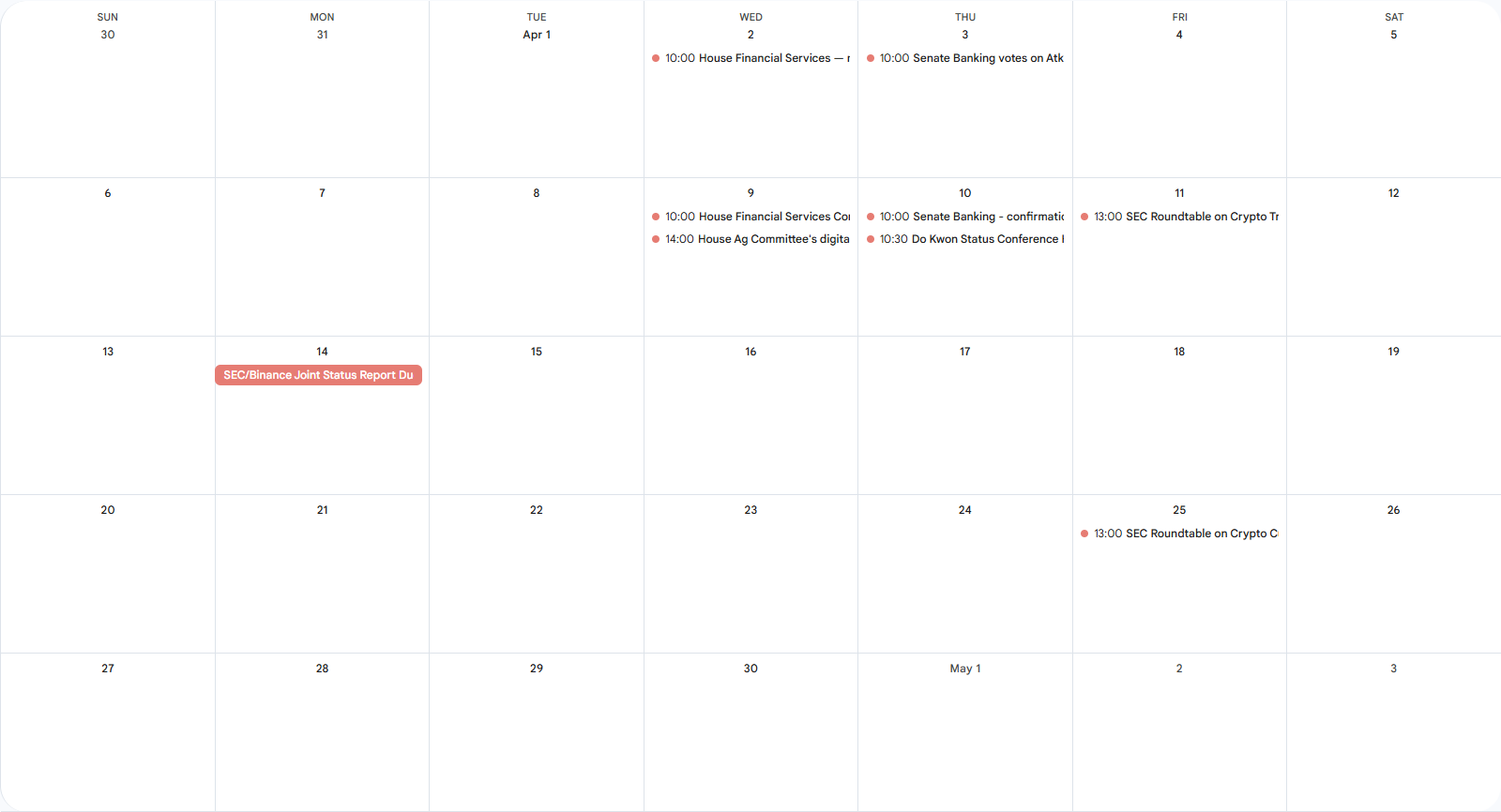

This week

Monday

- The Securities and Exchange Commission and Binance were set to file a joint status report on their discussions after a judge paused the regulator's case against the exchange and its affiliated entities and executives in February. Last Friday, the parties asked for an extension of this deadline, and the judge overseeing the case signed off on Monday, giving the parties until mid-June to file a follow-up.

Elsewhere:

- (The Wall Street Journal) Binance executives met with U.S. Treasury Department officials in March about potentially "loosening U.S. government oversight" of the exchange following Binance's November 2023 guilty plea, the Journal reported. Binance agreed to a court-appointed monitor as part of the plea. At the same time as last month's discussions, Binance was in talks with the Trump-backed World Liberty Financial to develop a dollar-pegged stablecoin.

- (Fortune) Fortune spoke to and profiled Bo Hines, the executive director of U.S. President Donald Trump's digital assets advisory council.

- (CNBC) U.S. importers are seeing more "canceled sailings" due to a drop in demand as a result of tariffs, CNBC reports.

- (The Verge) ICERAID claims to be a protocol on Solana where people can crowdsource images of "criminal illegal alien activity" in exchange for tokens, but it does not appear to have any connection to Immigration and Customs Enforcement (ICE), The Verge reports.

- (NPR) The Department of Homeland Security is revoking parole for a number of migrants, telling them to self-deport from the U.S. U.S. citizens, born within the U.S., are also receiving these emails.

- (The New York Times) Acting IRS Commissioner Gary Shapley has been replaced after just three days on the job, after Treasury Secretary Scott Bessent reportedly complained to President Donald Trump that he was not consulted on Shapley's promotion, which was pushed by Elon Musk.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Bluesky @nikhileshde.bsky.social.

You can also join the group conversation on Telegram.

See ya’ll next week!

source

https://www.coindesk.com/news-analysis/2025/04/19/unpacking-the-dojs-crypto-enforcement-memo