The bounce in crypto markets mostly stalled on Tuesday with the U.S. government on track to shut down at midnight Eastern time.

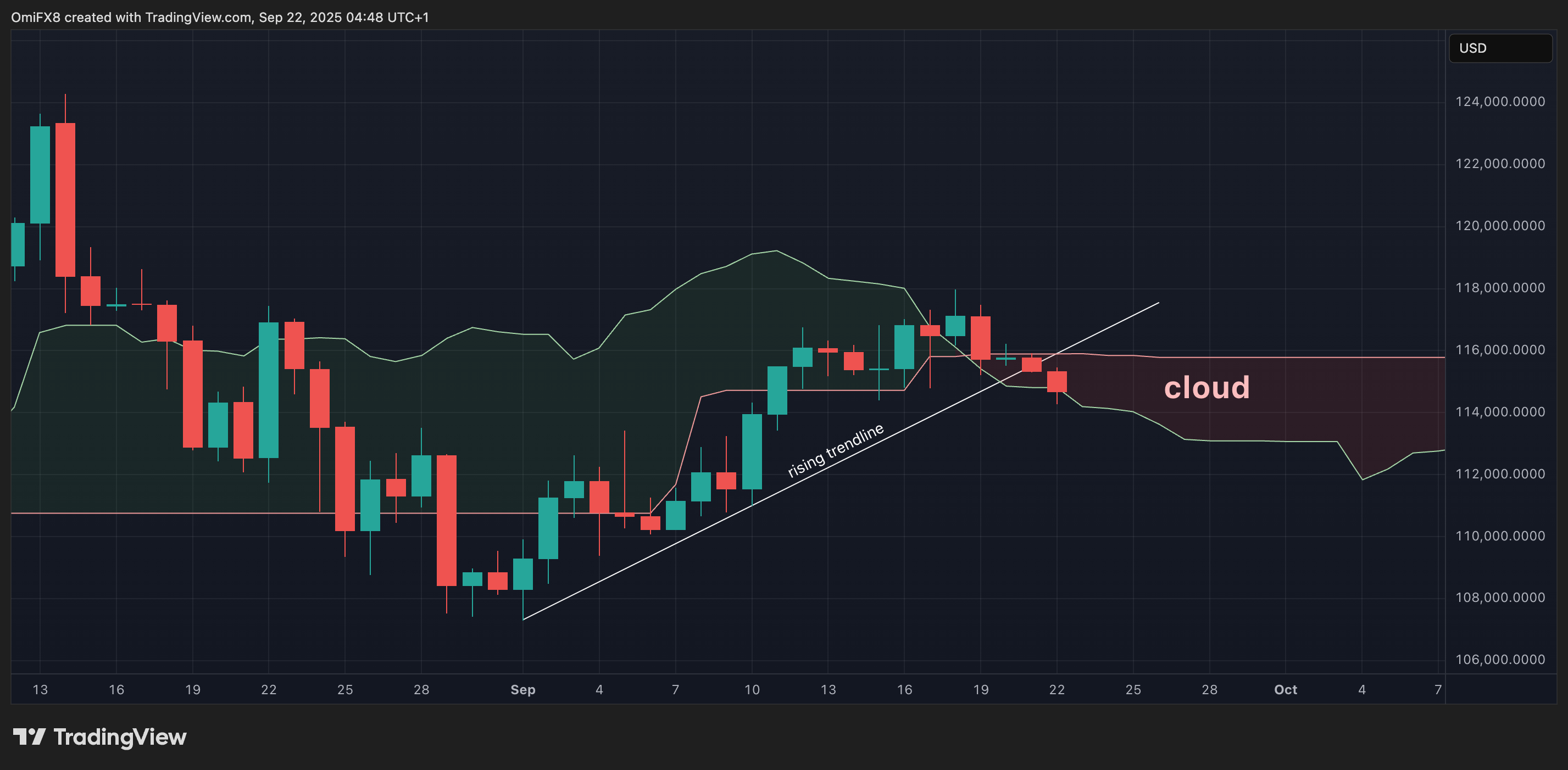

Bitcoin (BTC) — after earlier having slid about 2% from overnight highs near $115,000 - managed a late afternoon rally to $114,300, up marginally from 24 hours ago. Ether (ETH) traded just above $4,100, sliding 1.3% during the same period.

Most tokens in the broad-market benchmark CoinDesk 20 Index posted declines, with Avalanche (AVAX), Uniswap (UNI) and Near (NEAR) leading losses.

A check on traditional markets showed gold climbing another 0.5% to $3,850, extending its record-breaking run, while the Nasdaq and S&P 500 equity indexes also saw late rallies to move into positive territory just minutes ahead of the close.

Most market participants are in wait-and-see mode as the U.S. government seems headed toward a certain shutdown of uncertain length.

When the government shuts down, all non-essential activities under the executive branch will halt, which will likely include any of the Securities and Exchange Commission, Commodity Futures Trading Commission and federal bank regulators' ongoing efforts to create new rules for the crypto industry.

While the shutdown won't have an effect on people's ability to file comments for open rulemaking efforts, it's unlikely anyone at these agencies will be tasked to read the feedback. This halt may also affect ongoing efforts by companies to list and trade exchange-traded funds tied to cryptocurrencies like solana (SOL) and litecoin (LTC), CoinDesk reported earlier Tuesday.

Congress' work on crypto market structure legislation will be delayed. The Senate Banking Committee already postponed a tentatively planned markup — a hearing to debate provisions on the bill — on its market structure draft from Tuesday to later in October. The Senate Agriculture Committee has not published any draft legislation. The Senate Finance Committee, however, still intends to hold a hearing on Wednesday to examine crypto tax issues.

Shutdown leaves BTC fragile, Bitfinex warns

A shutdown would also halt the release of key economic indicators such as jobs data and CPI inflation reports that could amplify volatility across asset classes, including cryptos, Bitfinex analysts warned in a report.

Data delays could complicate the Federal Reserve's monetary policy decisions with ripple effects echoing across rates markets, the report noted. Global investors have already been cutting U.S. exposure, a trend which a protracted shutdown could accelerate, the report said.

"For markets, the immediate risk is confidence erosion and data blind spots, rather than systemic financial instability," Bitfinex analysts said about the potential shutdown.

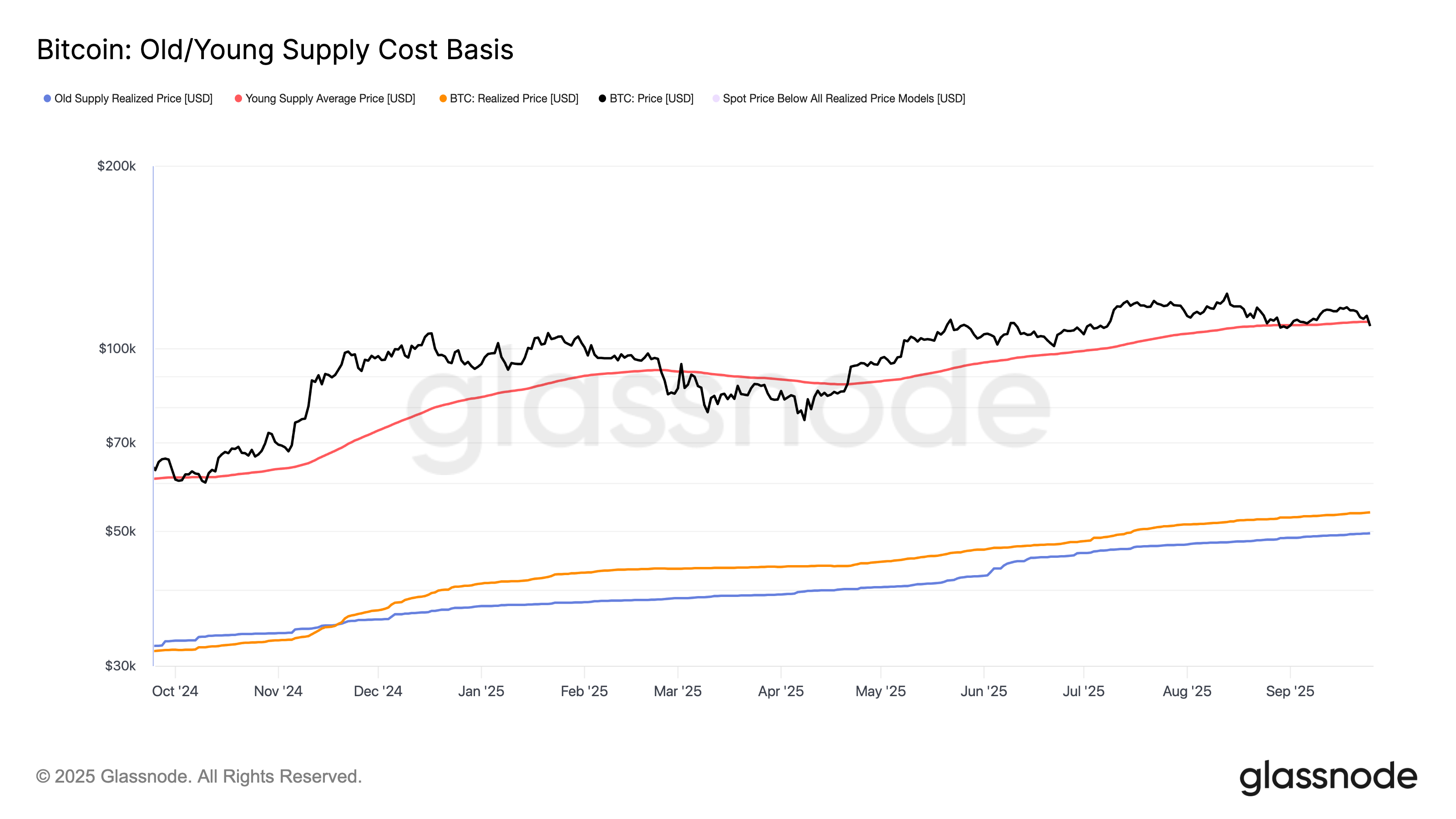

Zooming out, BTC is still in a corrective phase since the Fed's interest rate cut in September, which turned out to be a "buy the rumor, sell the news event," Bitfinex analysts said.

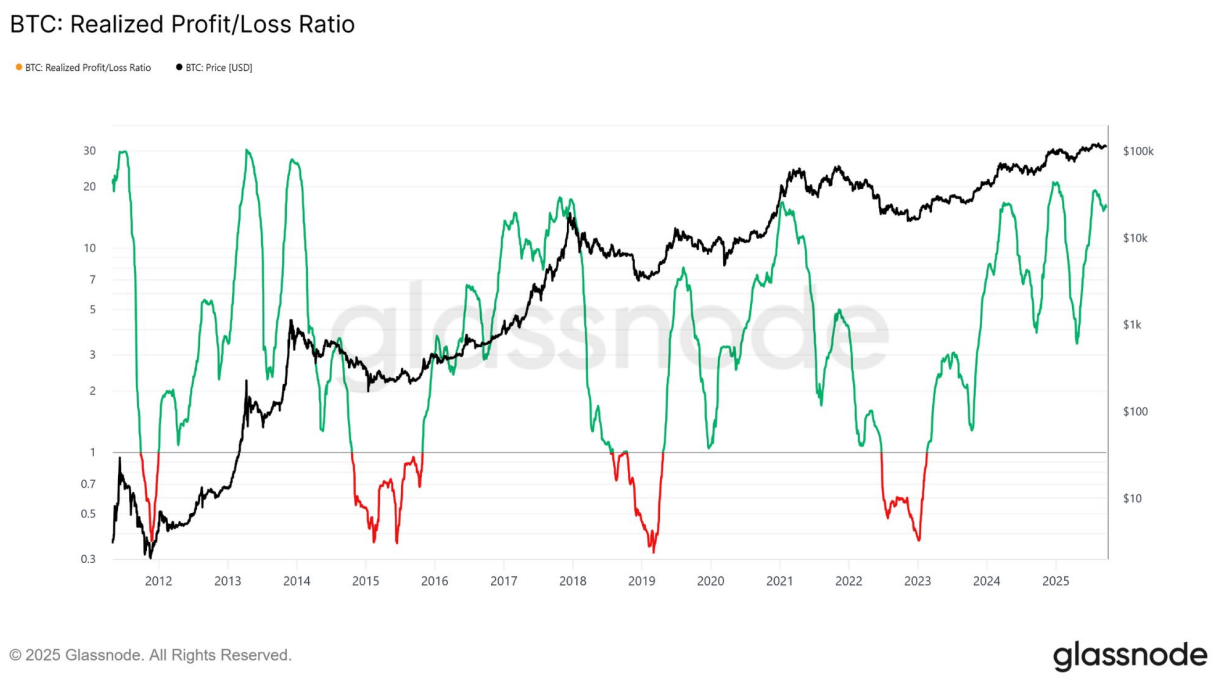

The report noted that unlike previous cycles, this one has unfolded in three distinct multi-month surges, each capped by widespread profit-taking.

"At every cyclical peak, more than 90 percent of coins moved were transacted in profit, a clear signal of widespread distribution," the analysts wrote.

Having just stepped back from the third such peak, Bitfinex analysts see probabilities tilting toward further consolidation.

"Deep political polarisation, rising fiscal deficits and a fragile global economy leave markets more sensitive to shocks," they added.

source https://www.coindesk.com/markets/2025/09/30/bitcoin-steady-but-bitfinex-warns-of-downside-risks-as-government-shutdown-looms