Friday, October 31, 2025

Crypto Bank Custodia Suffers Another Court Rejection in Fed Master Account Pursuit

source https://www.coindesk.com/policy/2025/10/31/crypto-bank-custodia-suffers-another-court-rejection-in-fed-master-account-pursuit

Thursday, October 30, 2025

Bitcoin Plunges Below Critical 200-Day Average as Dollar Surges to 3-Month High

source https://www.coindesk.com/markets/2025/10/30/bitcoin-plunges-below-critical-200-day-average-as-dollar-surges-to-3-month-high

Wednesday, October 29, 2025

Consensys Plans Public Debut, Taps JPMorgan and Goldman Sachs to Lead IPO: Axios

source https://www.coindesk.com/markets/2025/10/29/consensys-plans-public-debut-taps-jpmorgan-and-goldman-sachs-to-lead-ipo-axios

Mastercard Eyes Zero Hash Acquisition for Nearly $2B Bet on Stablecoins: Report

source https://www.coindesk.com/business/2025/10/29/mastercard-eyes-zero-hash-acquisition-for-nearly-usd2b-bet-on-stablecoins-report

What Bitcoin Chart Says About BTC Price After Powell Casts Doubt on December Cut?

source https://www.coindesk.com/markets/2025/10/29/E

Bitcoin Tumbles Back to $110K on Fed's Powell's Hawkish Comments

source https://www.coindesk.com/markets/2025/10/29/bitcoin-tumbles-back-to-usd110k-under-fed-s-powell-s-hawkish-comments

Tuesday, October 28, 2025

Ethereum’s Fusaka Upgrade Completes Final Hoodi Test Ahead of Mainnet Launch

source https://www.coindesk.com/tech/2025/10/28/ethereum-s-fusaka-upgrade-completes-final-hoodi-test-ahead-of-mainnet-launch

Western Union to Launch Stablecoin on Solana With Anchorage Digital

source https://www.coindesk.com/business/2025/10/28/western-union-to-launch-stablecoin-on-solana-with-anchorage-digital

Monday, October 27, 2025

Chainlink's LINK Gains as Whales Accumulate $188M After October Crypto Crash

source https://www.coindesk.com/markets/2025/10/27/chainlink-s-link-gains-as-whales-accumulate-usd188m-after-october-crypto-crash

Saylor's Strategy the First Bitcoin Treasury Company Rated by Major Credit Agency

source https://www.coindesk.com/markets/2025/10/27/saylor-s-strategy-the-first-bitcoin-treasury-company-rated-by-major-credit-agency

Sunday, October 26, 2025

Asia Morning Briefing: Bitcoin Holds Above $114K as Whales Absorb Supply and Shorts Rebalance

source https://www.coindesk.com/markets/2025/10/27/asia-morning-briefing-bitcoin-holds-above-usd114k-as-whales-absorb-supply-and-shorts-rebalance

Bitcoin Rebounds as $319M in Shorts Are Liquidated While Traders Eye U.S.-China Talks

source https://www.coindesk.com/markets/2025/10/26/bitcoin-rebounds-as-usd319m-in-shorts-are-liquidated-while-traders-eye-u-s-china-talks

Bitcoin Shines as a 'Liquidity Barometer,' Not an Inflation Hedge, NYDIG Says

source https://www.coindesk.com/markets/2025/10/26/bitcoin-shines-as-a-liquidity-barometer-not-an-inflation-hedge-nydig-says

Friday, October 24, 2025

Dogecoin Hits $0.20 as Breakout Volume Triples Average, Confirms Bullish Setup

source https://www.coindesk.com/markets/2025/10/25/dogecoin-hits-usd0-20-as-breakout-volume-triples-average-confirms-bullish-setup

Ripple Prime Is the Fintech Firm’s One-Stop Institutional Trading and Financing Desk

source https://www.coindesk.com/markets/2025/10/25/ripple-prime-is-the-fintech-firm-s-one-stop-institutional-trading-and-financing-desk

Thursday, October 23, 2025

Asia Morning Briefing: After CZ’s Pardon, Odds Rise for Sam Bankman-Fried’s Second Chance

source https://www.coindesk.com/markets/2025/10/24/asia-morning-briefing-after-cz-s-pardon-odds-rise-for-sam-bankman-fried-s-second-chance

The Crypto Industry Must Evolve to Match Real-World Security Risks

source https://www.coindesk.com/opinion/2025/10/22/the-crypto-industry-must-evolve-to-match-real-world-security-risks

Wednesday, October 22, 2025

Crypto Exchange Kraken Is Taking Staff on Caribbean Island Retreat in January: Sources

source https://www.coindesk.com/business/2025/10/22/crypto-exchange-kraken-is-taking-staff-on-caribbean-island-retreat-in-january-sources

Tuesday, October 21, 2025

XRP Edges Higher to $2.43 as Volume Surges Above Weekly Average

source https://www.coindesk.com/markets/2025/10/22/xrp-edges-higher-to-usd2-43-as-volume-surges-above-weekly-average

Bitcoin OG, Who Profited from Trump’s China Tariffs, Now Holds $234M in BTC Short Position: Arkham

source https://www.coindesk.com/markets/2025/10/22/bitcoin-og-who-profited-from-trump-s-china-tariffs-now-holds-usd234m-in-btc-short-position-arkham

Prediction Markets Say Government Shutdown Will be Record-Setting: Asia Morning Briefing

source https://www.coindesk.com/markets/2025/10/21/asia-morning-briefing-prediction-markets-say-government-shutdown-will-be-record-setting

Crypto’s ‘Decentralized’ Illusion Shattered Again by Another AWS Meltdown

source https://www.coindesk.com/news-analysis/2025/10/21/crypto-s-decentralized-illusion-shattered-again-by-another-aws-meltdown

Monday, October 20, 2025

Pantera-Backed Solana Company Brings Forward PIPE Unlock as Stock Price Plunges 60%

source https://www.coindesk.com/markets/2025/10/20/pantera-backed-solana-company-brings-forward-pipe-unlock-as-stock-price-plunges-60

AAVE Bounces Over 10% in Strong Weekend Recovery Amid RWA Integration Plans

source https://www.coindesk.com/markets/2025/10/20/aave-bounces-over-10-in-strong-weekend-recovery-amid-rwa-integration-plans

BlackRock UK Bitcoin ETP Starts Trading in London After FCA Eases Crypto Ban

source https://www.coindesk.com/markets/2025/10/20/blackrock-uk-bitcoin-etp-starts-trading-in-london-after-fca-eases-crypto-ban

Crypto Traders Eye Major Events to Relieve Market Woes: Crypto Week Ahead

source https://www.coindesk.com/markets/2025/10/16/crypto-traders-eye-major-events-to-relieve-market-woes-crypto-week-ahead

Sunday, October 19, 2025

Bitcoin Jumps Past $111K, XRP, SOL, ETH Rally as Japanese Shares Hit Record High

source https://www.coindesk.com/markets/2025/10/20/bitcoin-retakes-usd110k-xrp-sol-eth-rally-as-japanese-shares-hit-record-high

Japan Considers Allowing Banks to Trade Digital Assets Such as Bitcoin: Report

source https://www.coindesk.com/markets/2025/10/20/japan-considers-allowing-banks-to-hold-digital-assets-such-as-bitcoin-report

XRP, SOL Break Ahead with Bullish Reset in Sentiment as Bitcoin and Ether Stay Stuck in the Gloom

source https://www.coindesk.com/markets/2025/10/19/xrp-breaks-ahead-with-bullish-reset-in-sentiment-as-bitcoin-and-ether-stay-stuck-in-the-gloom

Saturday, October 18, 2025

Will Interest Payments Make Stablecoins More Interesting?

source https://www.coindesk.com/opinion/2025/10/17/will-interest-payments-make-stablecoins-more-interesting

DOGE Finds Support After Tariff-Led Selloff, Market Awaits Next Catalyst

source https://www.coindesk.com/markets/2025/10/18/doge-finds-support-after-tariff-led-selloff-market-awaits-next-catalyst

XRP Stabilizes After Early Dip, Traders Eye $2.40 Breakout

source https://www.coindesk.com/markets/2025/10/18/xrp-stabilizes-after-early-dip-traders-eye-usd2-40-breakout

Friday, October 17, 2025

Astra Nova Raises $48.3M to Grow Web3, AI Entertainment Ecosystem

source https://www.coindesk.com/business/2025/10/17/astra-nova-raises-usd48-3m-to-grow-web3-ai-entertainment-ecosystem

Thursday, October 16, 2025

U.S. Fed's Barr Catalogues Dangers to be Dodged in Future Stablecoin Regulations

source https://www.coindesk.com/policy/2025/10/16/u-s-fed-s-barr-catalogues-dangers-to-be-dodged-in-future-stablecoin-regulations

BNY Mellon Stays ‘Agile’ on Stablecoin Plans, Focuses on Infrastructure

source https://www.coindesk.com/business/2025/10/16/bny-mellon-stays-agile-on-stablecoin-plans-focuses-on-infrastructure

Wednesday, October 15, 2025

XRP Buildout Near $2.40 Could Precede Sharp Relief Rally if Whales Ease Pressure

source https://www.coindesk.com/markets/2025/10/16/xrp-buildout-near-usd2-40-could-precede-sharp-relief-rally-if-whales-ease-pressure

Asia Morning Briefing: QCP Says Global Liquidity, Not Fed Cuts, Is Powering the Market

source https://www.coindesk.com/markets/2025/10/16/asia-morning-briefing-qcp-says-global-liquidity-not-fed-cuts-is-powering-the-market

Bitcoin’s October Slowdown Masks Strength, Analysts Predict Catch-Up With Gold

source https://www.coindesk.com/markets/2025/10/15/bitcoin-s-october-slowdown-masks-strength-analysts-predict-catch-up-with-gold

Eric Trump Confirms Plans to Tokenize Real Estate With World Liberty Financial

source https://www.coindesk.com/business/2025/10/10/eric-trump-confirms-plans-to-tokenize-real-estate-with-world-liberty-financial

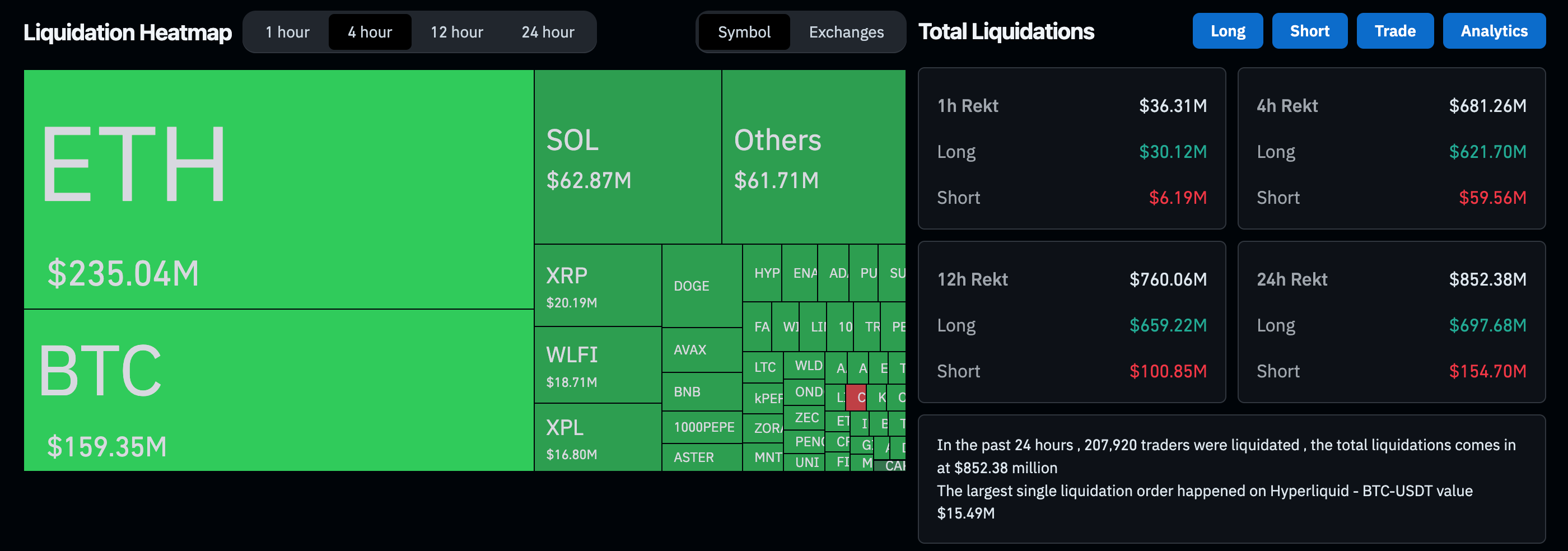

The Crypto Liquidation Crisis Highlighted OTC Desks as Crucial Shock Absorbers, Finery Markets Says

Over-the-counter (OTC) desks played a crucial role in stabilizing trading during the recent crypto market crash by acting as shock absorbers that contained volatility and limited broader systemic risks, according to a note from Finery Markets, a leading crypto ECN and trading SaaS provider ranked among the top 30 digital ...

source https://www.coindesk.com/markets/2025/10/15/the-usd19b-crypto-liquidation-crisis-highlighted-otc-desks-as-crucial-shock-absorbers-finery-markets-says

Tuesday, October 14, 2025

Asia Morning Briefing: Structural Demand Anchors Bitcoin After Record $20B Liquidation

Good Morning, Asia. Here's what's making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk's Crypto Daybook Americas.

Crypto's largest-ever leverage wipeout has left ...

source https://www.coindesk.com/markets/2025/10/15/asia-morning-briefing-structural-demand-anchors-bitcoin-after-record-usd20b-liquidation

Bitcoin's Leverage Flush Favors Accumulation, K33 Says

Crypto markets posted big declines on Tuesday, but signs of relief from the Federal Reserve helped prices bounce off their worst levels. A late day Truth Social post from President Trump reminded bulls that he has the power to reverse rising asset prices at any time.

Bitcoin (BTC) traded as ...

source https://www.coindesk.com/markets/2025/10/14/bitcoin-s-leverage-flush-favors-accumulation-k33-says

Celsius Wind-down Secures $300M From Tether, Say GXD Labs, VanEck

The wind-down of defunct crypto lender Celsius coughed up almost $300 million from Tether , according to a Tuesday statement from an entity set up by GXD Labs and VanEck, the Blockchain Recovery Investment Consortium. GXD Labs , a subsidiary of Atlas Grove Partners, and asset manager VanEck established BRIC ...

source https://www.coindesk.com/policy/2025/10/14/celsius-wind-down-secures-usd300m-from-tether-say-gxd-labs-vaneck

Monday, October 13, 2025

DOGE Faces Rejection at $0.22 as Dogecoin Treasury Firm Eyes Public Listing

Dogecoin traded volatile through the October 13–14 session, slipping 1% after failing to sustain a breakout above $0.22. The token found strong demand near $0.20 as institutional flows persisted, even as broader markets reacted to shifting trade rhetoric and renewed regulatory scrutiny following House of Doge’s Nasdaq debut.

News Background

Markets steadied after the Trump administration softened its tone on China tariffs, triggering a partial rebound in risk assets. DOGE bounced from $0.18 lows earlier in the week to test $0.22 resistance before profit-taking emerged. The listing of House of Doge — the meme coin’s affiliated entity — via reverse merger on Nasdaq has amplified corporate exposure to digital assets, but also raised regulatory compliance challenges for institutional investors.

“The participation patterns we’re seeing — strong morning sell volume and disciplined evening accumulation — are hallmarks of active institutional management,” said a senior strategist at a digital asset trading desk. “Treasury teams are hedging volatility but not exiting positions.”

Price Action Summary

- DOGE fluctuated between $0.20–$0.22 from Oct. 13 03:00 to Oct. 14 02:00, closing at $0.21.

- Resistance capped at $0.22 after a 21:00 rejection on above-average volume.

- Heavy institutional buying appeared near $0.20 during 11:00 session with 1.52 B tokens traded.

- A liquidation burst at 01:54 drove $0.21 breach on 39.6 M volume as algo selling triggered stops.

- Session stabilized around $0.21 with consistent accumulation into close.

Technical Analysis

DOGE continues to oscillate within a $0.20–$0.22 band, consolidating recent 11% gains. Support remains well-defined at $0.20 with multiple high-volume rebounds. The $0.22 ceiling has now been tested three times without sustained follow-through, forming a near-term pivot for momentum traders.

Volume concentration at $0.21 indicates institutional inventory building rather than panic distribution. Should price hold above $0.21 through the next session, upside targets re-emerge toward $0.23–$0.24; failure to defend $0.20 risks a retrace toward $0.18.

What Traders Are Watching

- Whether DOGE can reclaim and hold $0.22 to confirm continuation toward $0.24.

- Signs of renewed whale inflows after 1.5 B tokens accumulated near $0.20 support.

- Corporate and regulatory headlines tied to House of Doge’s listing.

- Broader meme-coin sentiment as XRP and SHIB trade flat on declining volume.

source https://www.coindesk.com/markets/2025/10/14/doge-faces-rejection-at-usd0-22-as-dogecoin-treasury-firm-eyes-public-listing

Asia Morning Briefing: China Renaissance’s BNB Treasury Highlights a Shift in Asia’s Crypto Playbook

Good Morning, Asia. Here's what's making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk's Crypto Daybook Americas.

China Renaissance’s reported plan to raise $600 million for a BNB-focused investment vehicle, with Binance founder Changpeng Zhao's YZi Labs investing alongside, may look like a straightforward bet on Binance’s ecosystem. But Singapore-based market maker Enflux argues it’s something deeper: a signal that Asian institutions are building a different kind of crypto exposure than their Western counterparts.

“Regional capital allocators are seeking exposure to infrastructure tokens that drive transaction flow, not just store-of-value assets,” Enflux said in a note to CoinDesk, framing the China Renaissance move as part of a broader divergence between East and West.

BNB is a great example of this. Binance, of course, isn't a listed company, but BNB serves as something very close to a stock. Its value is a proxy for market sentiment and confidence in Binance.

While U.S. and European markets have leaned into tokenized Treasuries, funds, and real-world assets, Asia’s capital markets are increasingly constructing crypto-native liquidity networks centered around exchange, staking, and transaction infrastructure.

"This ties into the broader shift where Asian capital markets are building out their own layer of crypto-native liquidity networks while Western markets tokenized TradFi," Enflux continued.

The logic is straightforward. Value should be accrued by activity, not scarcity. Tron's move to create a publicly listed company to give investors listed exposure to activity on the TRX network – which is heavily used to send USDT around Latin America – follows the same train of thought.

If Enflux’s thesis is right, the China Renaissance fund could be an early blueprint for Asia’s next wave of institutional products: permanent capital vehicles that hold the pipes of the crypto economy, not just its gold.

Market Movement:

BTC: BTC is trading above $114,500, relatively flat as the market stabilizes after last weekend's volatility.

ETH: ETH rose 1.5% to $4,230 as network activity picked up, even as U.S.-listed Ethereum ETFs saw $118 million in outflows.

Gold: Gold surged 2% to a record $4,103 an ounce as renewed U.S.-China trade tensions and expectations of further Fed rate cuts drove investors toward safe-haven assets.

Nikkei 225: Asia-Pacific markets traded mixed Tuesday as Trump’s conciliatory remarks on China failed to offset renewed trade tensions, with Japan’s Nikkei 225 down 1.34%.

Elsewhere in Crypto:

- Crypto market structure bill may need to wait until after the midterm election, says TD Cowen (The Block)

- Tom Lee's Bitmine Bought the Dip, Adding Over 200K ETH to Ethereum Treasury (CoinDesk)

- Ripple Is Offering $200K to 'Attack' XRP Ledger Lending Protocol (Decrypt)

source https://www.coindesk.com/markets/2025/10/14/asia-morning-briefing-china-renaissance-s-bnb-treasury-highlights-a-shift-in-asia-s-crypto-playbook

Citi Eyes 2026 Crypto Custody Launch After Years of Quiet Development: CNBC

Citi (C) plans to offer crypto custody services in 2026, enabling the bank to hold native digital assets like bitcoin and ether on behalf of clients, according to a report by CNBC.

The move marks another step by the Wall Street bank into the digital asset space. Biswarup Chatterjee, Citi’s global head of partnerships and innovation for services, said the custody solution has been in development for two to three years.

“We have various kinds of explorations,” Chatterjee told CNBC. “We’re hoping that in the next few quarters, we can come to market with a credible custody solution that we can offer to our asset managers and other clients.”

The custody plan would give institutional clients a regulated way to store crypto, a piece of infrastructure many traditional investors view as essential for exposure to the sector.

Chatterjee said Citi is pursuing a hybrid approach, developing some custody tools internally while also exploring outside partnerships.

“We may have certain solutions that are completely designed and built in-house … whereas we may use a third-party, lightweight, nimble solution for other kinds of assets,” he said. “We’re not currently ruling out anything.”

The custody offering would join a growing portfolio of digital asset experiments at Citi. During the bank’s second-quarter earnings call in July, CEO Jane Fraser said Citi is also exploring a stablecoin issuance, though she noted that tokenized deposits are a more immediate focus.

Last week, Citi Ventures invested in BVNK, a stablecoin payments startup, alongside Visa. That deal followed earlier experiments in blockchain-based trade finance and cross-border payments.

If launched, Citi’s custody service would place the bank among a small but growing group of traditional financial institutions entering the crypto back office.

source https://www.coindesk.com/markets/2025/10/13/citi-eyes-2026-crypto-custody-launch-after-years-of-quiet-development-cnbc

Sunday, October 12, 2025

Tether CEO Paolo Ardoino: ‘Bitcoin and Gold Will Outlast Any Other Currency’

Tether CEO Paolo Ardoino said in a post on X on Sunday that "Bitcoin and Gold will outlast any other currency," a minimalist line that aligns with how the stablecoin issuer has positioned parts of its reserves over the past two years.

On May 17, 2023, Tether said it would regularly allocate up to 15% of net realized operating profits to purchase bitcoin for reserves, adding BTC to surplus rather than using it to back circulating USDT one-for-one. The company framed the move as strengthening its balance sheet with a long-term store of value.

BTC and gold as parallel pillars

Gold sits alongside bitcoin in that mix.

Tether issues tether gold (XAUt), a token backed by allocated bars, and said on July 24 that more than 7.66 tons of metal backed outstanding tokens as of June 30, 2025. Separately, as CoinDesk reported on Sept. 5, 2025, citing the Financial Times, Tether has held talks to invest across the gold value chain — from mining and refining to royalties — as part of a broader diversification push.

Ardoino has grouped the assets rhetorically before. On Sept. 7, he referenced bitcoin, gold and land as hedges and later dismissed suggestions that Tether sold BTC to accumulate gold, saying the firm remained committed to growing its bitcoin position.

Today's eight-word post is less a policy shift than a restatement — bitcoin as a strategic asset added with profits, and gold as a parallel pillar via tokenization and potential upstream investments — while most reserves remain in liquid instruments such as U.S. Treasurys per attestations. The next reserve report, expected late this month or early next month, will show whether allocations to BTC and gold have changed.

As of Sunday, 8:10 p.m. UTC, the U.S. dollar index (DXY) was down 8.88% year to date, while bitcoin and gold — BTC-USD and XAU-USD — were up 22.79% and 52.91%, respectively, according to MarketWatch.

source https://www.coindesk.com/markets/2025/10/12/tether-ceo-paolo-ardoino-bitcoin-and-gold-will-outlast-any-other-currency

Saturday, October 11, 2025

Friday’s $20B Crypto Market Meltdown: A Bitwise Portfolio Manager’s Postmortem Analysis

Friday’s sell-off triggered what Bitwise portfolio manager Jonathan Man called the worst liquidation event in crypto history, with more than $20 billion wiped out as liquidity vanished and forced deleveraging took hold, in an article on X published Saturday.

Perpetual futures — “perps” in trading shorthand — are cash-settled contracts with no expiry that mirror spot via funding payments, not delivery. Profits and losses net against a shared margin pool, which is why, in stress, venues may need to reallocate exposure quickly to keep books balanced.

Man, who is the lead portfolio manager of the Bitwise Multi-Strategy Alpha Fund, said bitcoin fell 13% from peak to trough in a single hour, while losses in long-tail tokens were far steeper — he added that ATOM “fell to virtually zero” on some venues before rebounding.

He estimated roughly $65 billion in open interest was erased, resetting positioning to levels last seen in July. The headline numbers, he argued, mattered less than the plumbing: when uncertainty spikes, liquidity providers widen quotes or step back to manage inventory and capital, organic liquidations stop clearing at bankruptcy prices, and venues turn to emergency tools.

According to Man, exchanges in that situation leaned on safety valves.

He said auto-deleveraging kicked in at some venues, forcibly closing part of profitable counter-positions when there was not enough cash on the losing side to pay winners.

He also pointed to liquidity vaults that absorb distressed flow — Hyperliquid’s HLP “had an extremely profitable day,” he said, buying at deep discounts and selling into spikes.

What failed and what held

Man said centralized venues saw the most dramatic dislocations as order books thinned, which is why long-tail tokens broke harder than bitcoin and ether.

By contrast, he said DeFi liquidations were muted for two reasons: major lending protocols tend to accept blue-chip collateral such as BTC and ETH, and Aave and Morpho “hardcoded USDe’s price to $1,” limiting cascade risk.

Although USDe remained solvent, he said it traded around $0.65 on centralized exchanges amid illiquidity — leaving users who posted it as margin on those venues vulnerable to liquidation.

Beyond directional traders, Man highlighted hidden exposures for market-neutral funds. He said the real risks on days like Friday are operational — algorithms running, exchanges staying up, accurate marks, the ability to move margin and execute hedges on time.

He checked in with several managers who reported they were fine, but said he would not be surprised if “some c-tier trading teams got carried out.”

Man also described unusually wide dispersion across venues, citing $300-plus spreads at times between Binance and Hyperliquid on ETH-USD.

Prices recovered from extreme lows, he said, and positioning flushes created opportunities for traders with dry powder. Man also mentioned that with open interest down sharply, markets entered the weekend on firmer footing than the day before.

source https://www.coindesk.com/markets/2025/10/12/friday-s-usd20b-crypto-market-meltdown-a-bitwise-portfolio-manager-s-postmortem-analysis

How Auto-Deleveraging on Crypto Perp Trading Platforms Can Shock and Anger Even Advanced Traders

Auto-deleveraging is the emergency brake in crypto perpetuals that cuts part of winning positions when bankrupt liquidations overwhelm market depth and a venue’s remaining buffers, as Ambient Finance Founder Doug Colkitt explains in a new X thread.

Perpetual futures — “perps” in trading shorthand — are cash-settled contracts with no expiry that mirror spot via funding payments, not delivery. Profits and losses net against a shared margin pool rather than shipped coins, which is why, in stress, venues may need to reallocate exposure quickly to keep books balanced.

Colkitt frames ADL as the last step in a risk waterfall.

In normal conditions, a blown-up account is liquidated into the order book near its bankruptcy price. If slippage is too severe, venues lean on whatever buffers they maintain — insurance funds, programmatic liquidity, or vaults dedicated to absorbing distressed flow.

Colkitt notes that such vaults can be lucrative during turmoil because they buy at deep discounts and sell into sharp rebounds; he points to an hour during Friday's crypto meltdown when Hyperliquid’s vault booked about $40 million.

The point, he stresses, is that a vault is not magic. It follows the same rules as any participant and has finite risk capacity. When those defenses are exhausted and a shortfall still remains, the mechanism that preserves solvency is ADL.

The analogies in Colkitt’s explainer make the logic intuitive.

He likens the process to an overbooked flight: the airline raises incentives to find volunteers, but if no one bites, “someone has to be kicked off the plane.”

In perps, when bids and buffers will not absorb the loss, ADL “bumps” part of profitable positions so the market can depart on time and settle obligations.

He also reaches for the card room.

A player on a hot streak can win table after table until the room effectively runs out of chips; trimming the winner is not punishment, it is how the house keeps the game running when the other side cannot pay.

How the queue works

When ADL triggers, exchanges apply a rule to decide who gets reduced first.

Colkitt describes a queue that blends three factors: unrealized profit, effective leverage, and position size. That math typically pushes large, highly profitable, highly leveraged accounts to the front of the line—“the biggest, most profitable whales get sent home first,” as he puts it.

Reductions are assigned at preset prices tied to the bankrupt side and continue only until the deficit is absorbed. Once the gap closes, normal trading resumes.

Traders bristle because ADL can clip a correct position at peak momentum and outside normal execution flow.

Colkitt acknowledges the frustration but argues the necessity is structural. Perp markets are zero sum. There is no warehouse of real bitcoin or ether behind a contract, only cash claims moving between longs and shorts.

In his words, it is “just a big boring pile of cash.” If a liquidation cannot clear at or above the bankruptcy price and buffers are spent, the venue must rebalance instantly to avoid bad debt and cascading failures.

Colkitt emphasizes that ADL should be rare, and most days it is.

Standard liquidations and buffers usually do the job, allowing profitable trades to exit on their own terms.

The existence of ADL, however, is part of the compact that lets venues offer non-expiring, high-leverage exposure without promising an “infinite stream of losers on the other side.” It is the final line in the rulebook that keeps the synthetic mirror of spot from cracking under stress.

He also argues that ADL exposes the scaffolding that typically stays hidden.

Perps build a convincing simulation of the underlying market, but extreme tapes test the illusion.

The “edge of the simulation” is when the platform must reveal its accounting and forcibly redistribute exposure to keep parity with spot and stop a cascade. In practice, that means a transparent queue, published parameters, and, increasingly, on-screen indicators that show accounts where they sit in the line.

Colkitt’s broader message is pragmatic.

No mechanism can guarantee painless unwinds, only predictable ones. The reason ADL provokes strong reactions is that it strikes winners, not losers, and often at the most visible moment of success. The reason it persists is that it is the only step left once markets refuse to clear and buffers run dry.

For now, exchanges are betting that clear rules, visible queues and thicker buffers keep ADL what it should be — a backstop you rarely see but never ignore.

source https://www.coindesk.com/markets/2025/10/11/how-adl-on-crypto-perp-trading-platforms-can-shock-and-anger-even-advanced-traders

Ethena's USDe Briefly Loses Peg During $19B Crypto Liquidation Cascade

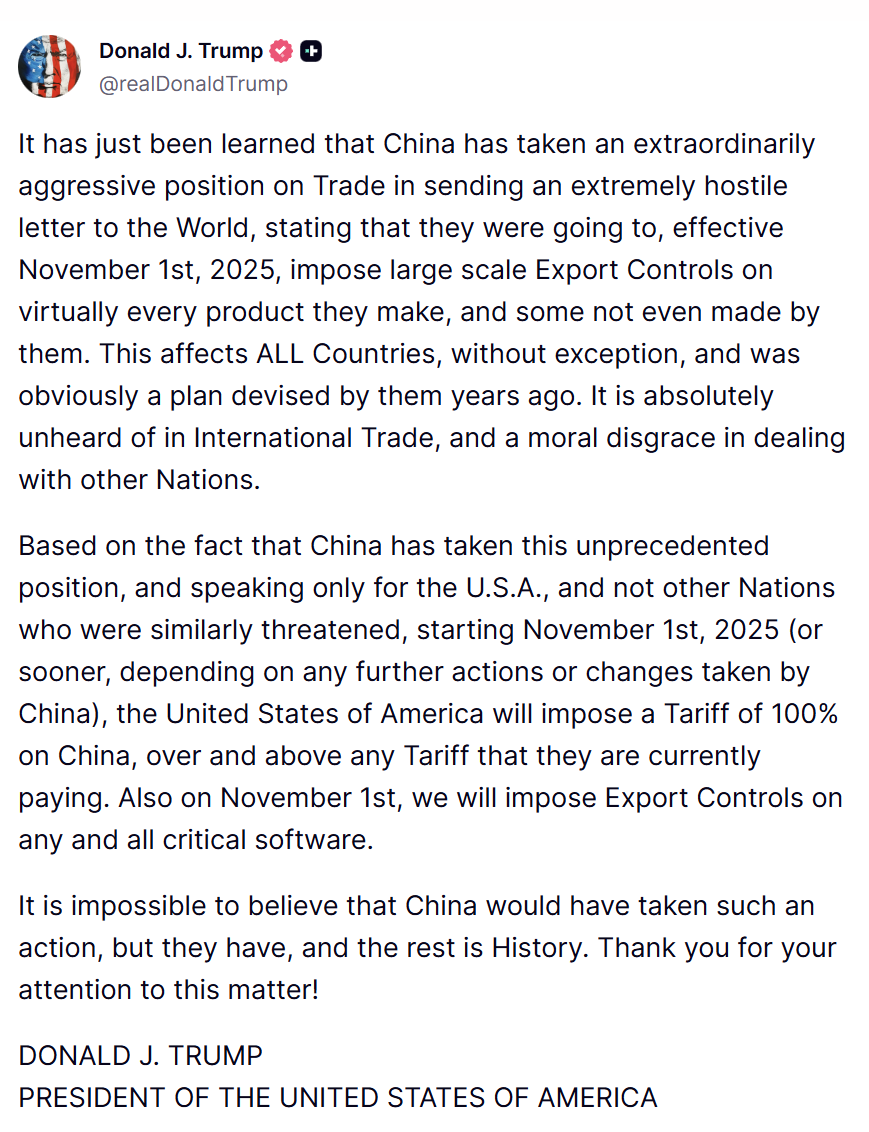

Ethana’s yield-bearing stablecoin, USDe, briefly lost its 1:1 dollar peg during the recent sharp market sell-off triggered by U.S. President Donald Trump’s announcement of a 100% additional tariff on China.

On Binance, USDe dropped to 65 cents before quickly regaining parity with the dollar during what’s seen as crypto’s largest ever liquidation event in U.S. dollar value. More than $19 billion in liquidations occurred over just 24 hours.

USDe, which currently offers a 5.5% yield to holders, is backed by a mix of cryptocurrencies and uses a basis trade strategy, a financial setup that aims to profit from price gaps between spot and futures markets.

Trump’s shock announcement sent investors fleeing to safe havens like gold and U.S. Treasuries.

USDe’s dip had outsized effects, according to crypto trader and economist Alex Krüger, as tokens that aren’t as actively traded on centralized exchanges “didn’t suffer as much” and some quickly recovered from the drop.

This is as exchanges like Binance and Bybit marked the price closer to real-time trading, while lending protocols like Aave had USDe hardcoded it at $1, which shielded them from some of the immediate impact of the brief depew.

Ethena Labs said in a social media post that USDe remains over-collateralized and that widespread liquidations affected the secondary market price of USDe.

“We can confirm the mint & redeem functionality has remained operational throughout with no downtime experienced, and USDe remains overcollateralised,” Ethena Labs wrote in the post.

“Due to liquidations perpetual contracts have been and continue to trade below spot. This creates additional unexpected uPNL within USDe, due to Ethena being short these contracts, which is currently in the process of being realised to the benefit of the protocol,” the project added.

Binance has said it’s reviewing affected accounts and liquidations, along with the “appropriate compensation measures.”

Ethena’s governance token, ENA, fell as much as 40% during the slide before it started to recover. It’s down nearly 25% in the last 24-hour period.

source https://www.coindesk.com/markets/2025/10/11/ethena-s-usde-briefly-loses-peg-during-usd19b-crypto-liquidation-cascade

Friday, October 10, 2025

Biggest Crypto Liquidation Ever Sees $16B Longs Decimated Amid Market Chaos

Crypto liquidations continued their rout early morning Asia hours after the broader crypto market continued its plunge hours after U.S. President Donald Trump threatened 100% tariffs on Chinese imports via a Truth Social post, which triggered a global risk-off wave and wiped out more than $16 billion in long positions by midday Hong Kong time.

Trader anxiety that a cooling trade war was about to re-ignite sent a macro shock rippling through crypto, triggering one of the largest long declines in prices of BTC, ETH and other digital assets seen all year.

Bitcoin recovered to $113,294 and Ether to $3,844 as the CoinDesk 20 Index slid 12.1%. The world's largest cryptocurrency had fallen below $110,000 briefly, marking a 10% decline over the past 24 hours.

Crypto's total market cap dropped to $3.87 trillion, and roughly $16.7 billion of the $19.1 billion in liquidations came from longs, while Ethena’s USDe briefly printed $0.9996, a mild deviation that highlights peg stress when derivatives markets whipsaw.

Friday's crash saw crypto's worst liquidation in terms of pure volume, seeing over 10 times as much dollar value liquidated as the crashes when FTX collapsed in 2022 or when global markets melted down during the early COVID lockdowns. At a percentage level, Friday's crash is much less significant, given how much the overall crypto market has grown since 2022.

CoinGlass said in a post on X that while it recorded $19.13 billion in liquidations, "the actual total is likely much higher," noting that crypto exchange Binance — the largest in the world — does not report as quickly as other platforms.

The Ethena team said USDe minting and redemptions remained fully operational despite the volatility and pointed out that the stablecoin is even more overcollateralized as unrealized gains from short positions are realized.

Adding to traders’ concerns, the U.S. government shutdown has delayed key economic data releases, leaving markets to navigate without official indicators just as trade war rhetoric returns to center stage.

UPDATE (Oct. 11, 2025, 04:00 UTC): Adds context on the significance of Friday's liquidations.

UPDATE (Oct. 11, 04:20 UTC): Adds CoinGlass note.

source https://www.coindesk.com/markets/2025/10/10/usd16b-in-longs-liquidated-as-wall-street-sell-off-extends-btc-eth-broader-crypto-market-meltdown

Bitcoin Crashes Below $110K, $7B in Bets Liquidated on Further Trump Tariff on China

Friday has gone from bad to worse for crypto assets as U.S. President Trump said he would impose an additional 100% tariff on China, sending prices cascading lower in a flash crash.

Bitcoin (BTC), already trading weak at around $117,000 following Trump's late morning comments about threatening China with tariffs, tumbled below $110,000, down 12% over the past 24 hours. Ether (ETH) tanked 16% below $3,700, while other major altcoins XRP (XRP), solana (SOL) and dogecoin (DOGE) crashed 20%-30%. The native tokens of Cardano (ADA), Chainlink (LINK) and Aave (AAVE) fell as much as 40%

Friday's market meltdown lead to over $7 billion in liquidations from traders who bet on higher prices, according to CoinGlass.

The latest flare-up in trade tensions between U.S. and China occurred as Trump said he would increase tariffs in Chinese goods in response to China's export controls on rare earth metals. Then, after traditional markets closed for the week, he announced in an Truth Social post late Friday afternoon that he would impose an additional 100% tariff starting on November 1.

"Also on November 1, we will impose export controls on any and all critical software," he said.

Bitcoin fell $3,000 immediately at the time that post went live.

The violent price action was one for the ages, with some analysts comparing it to the market crash in March 2020 induced by the Covid-19 pandemic lockdowns.

"Covid level nukes," prominent trader Bob Loukas said about the crash in an X post. "Wow, nasty, nasty action. But also a great candidate for the mother of shakeouts," he added.

"Brutal day," said Ram Ahluwalia, founder of investment firm Lumida Wealth. "The Trump news combined with 'overbought' conditions led to a sharp decline."

"I know there are a lot of emotions right now and this flush is in the top 3 all time," well-followed trader Pentoshi posted, adding that altcoins dropped as violently as during the COVID crash. "There are a lot of people in incredible pain right now, myself included in that."

Read more: Trump Tariff Threat on China Sends Bitcoin Tumbling Below $119K

UPDATE (Oct. 10, 2025, 21:55 UTC): Adds updated liquidation figure.

UPDATE (Oct. 10, 2025, 22:12 UTC): Adds comments from traders.

source https://www.coindesk.com/markets/2025/10/10/bitcoin-crashes-below-usd110k-cryptos-in-freefall-on-further-trump-tariff-on-china

Galaxy Gets $460M Investment by 'Large Asset Manager' for Its HPC Push

Digital asset investment firm Galaxy Digital (GLXY) said on Friday it agreed to a $460 million private investment from one of the world’s largest asset managers, a deal that would add cash for its growing data center business and general corporate needs.

The investment, from the undisclosed firm, is split between 9,027,778 new Class A shares issued by Galaxy and 3,750,000 shares sold by certain executives, including founder and CEO Mike Novogratz, at $36 per share, according to the press release. That's an 8.5% discount from Friday's closing price.

"Strengthening our balance sheet is essential to scaling Galaxy's data center business efficiently while maintaining the financial flexibility to support future growth," said Novogratz. "

Having one of the world's largest and most sophisticated institutional investors make such a significant investment in our company will support our strategic vision and our ability to build leading businesses across digital assets and data centers."

The transaction is slated to close on or about October 17, subject to customary conditions, including approval by the Toronto Stock Exchange.

Mining to AI

The firm said the funds will help build out its Helios data center campus, which is scheduled to deliver 133 megawatts of critical IT load in the first half of 2026 under its Phase One lease.

Galaxy bought Helios from struggling miner Argos in 2022 to operate as a mining operation. However, as bitcoin mining became increasingly difficult with thin margins, Galaxy, like many other miners, pivoted its mining operations towards a data center for AI and HPC computing.

Since then, Galaxy has been increasingly investing in Helios to rapidly expand and reinvent it as an AI and HPC hosting data center.

The new deal comes after Galaxy announced this summer that it had secured $1.4 billion in funding to expand Helios. That deal followed a lease agreement with AI cloud provider CoreWeave (CRWV), which has now committed to all 800 megawatts of approved power capacity at Helios.

This AI push by Galaxy has been a welcome development in the market, as investors and analysts view the pivot as a move that could add more value to the stock. Galaxy shares jumped 3% in post-market trading on the news of the new deal.

Read more: The Bull Case for Galaxy Digital Is AI Data Centers Not Bitcoin Mining, Research Firm Says

source https://www.coindesk.com/business/2025/10/10/galaxy-gets-usd460m-investment-by-large-asset-manager-for-its-hpc-push

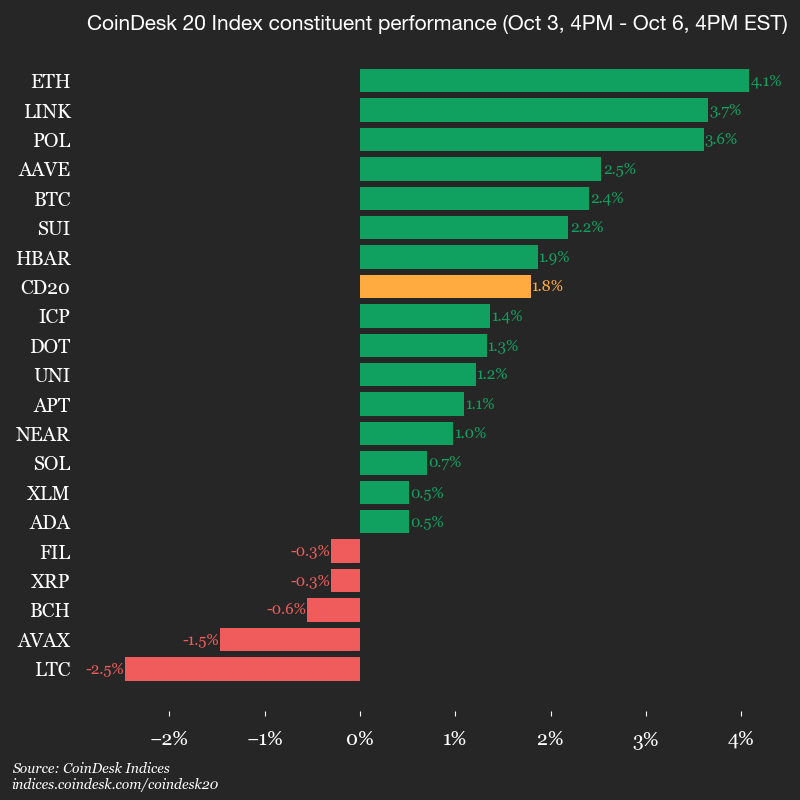

Ether's 7% Plunge Leads Crypto Liquidations in $600M Carnage

Friday brought carnage onto crypto markets as U.S.-China trade tensions ratcheted up with Trump threatening a massive increase in tariffs against Chinese goods.

Worst-hit among the crypto benchmark CoinDesk 20 Index constituents was Ethereum's native token ether (ETH), nosediving 7% from Friday's session high and hitting its weakest price since late September below $4,100. Its decline far outpaced bitcoin's (BTC) 3.5% drop below $118,000 and the index's 5% plunge.

The broad-market downturn spurred a liquidation cascade across crypto derivatives markets, wiping out over $600 million of leveraged trading positions among all assets, CoinGlass data shows.

ETH also led in liquidations with over $235 million long positions wiped out through the session. Longs are leveraged bets seeking to profit from the asset's price rise.

Technical breakdown

Behind the liquidation cascade was ETH's breakdown of critical support levels, CoinDesk Research's technical analysis model suggested.

• Selling pressure materialized at around 14:00 UTC with a volume of 372,211 units, almost double than the 24-hour average of 190,747 units.

• Volume-based resistance confirmed around $4,287.

• Primary resistance identified at $4,141 during failed recovery attempt.

• Potential support forming just below $4,100 where buyers emerged.

source https://www.coindesk.com/markets/2025/10/10/ether-s-7-plunge-leads-crypto-liquidations-in-usd600m-carnage

Thursday, October 9, 2025

'Bitcoin Jesus' to Settle U.S. Tax, Fraud Charges: NYT

Early Bitcoin (BTC) investor and Bitcoin Cash (BCH) advocate Roger Ver is close to settling tax fraud charges with the U.S. Department of Justice, the New York Times reported Thursday.

Often known as "Bitcoin Jesus" due to his early evangelization for the crypto, Ver was indicted last April and arrested in Spain on allegations he failed to file tax returns on capital gains he made after selling "tens of thousands" of bitcoins and giving up U.S. citizenship, the DOJ charged at the time. Ver fought his extradition to the U.S., filing a lawsuit earlier this summer.

According to the Times, the proposed settlement is subject to change but would see Ver paying about $48 million for the taxes he allegedly owes. It has not yet been filed to or approved by the federal judge overseeing the case.

A spokesperson for the U.S. Department of Justice's Los Angeles office, which filed the indictment, referred CoinDesk to the DOJ's main offices in Washington, D.C. A spokesperson for the D.C. office did not immediately return a request for comment. Ver did not return a request for comment.

Ver told the Times he could not comment.

The court docket shows there is a hearing scheduled for Dec. 15, 2025.

Ver tapped Roger Stone, an associate of U.S. President Donald Trump, to lobby for his assistance in resolving the case, according to a lobbying registration Stone filed earlier this year.

Trump has pardoned a number of other crypto figures since retaking office as president earlier this year, including Ross Ulbricht, Arthur Hayes and other founders of Bitmex — as well as Bitmex itself, after the company previously pled guilty to violating the Bank Secrecy Act.

Changpeng "CZ" Zhao, the founder of Binance, has applied for a presidential pardon as well, after serving four months in prison after his guilty plea tied to Binance's anti-money laundering compliance.

source https://www.coindesk.com/policy/2025/10/09/bitcoin-jesus-to-settle-u-s-tax-fraud-charges-nyt

Filecoin Drops as Much as 7% as Selling Pressure Intensifies

Filecoin (FIL) fell as much as 7% in the last 24 hours, tumbling from $2.39 to $2.23, according to CoinDesk Research's technical analysis model.

The model showed that the token posted a $0.19 range representing 7.9% volatility.

Sellers dominated at the $2.41 resistance level as transaction volume exploded to 5.92 million tokens traded, crushing the 3.42 million daily average. Bulls defended $2.23 support, with volume spiking above 4.8 million, according to the model.

Classic capitulation patterns emerged as selling exhaustion signaled potential base formation above critical $2.23 floor, the model said.

In recent trading, Filecoin was 5.1% lower, around $2.26.

The wider crypto market also declined, with the broad market gauge, the CoinDesk 20, down 3.6%.

Technical Analysis:

- Sellers defended the $2.41 resistance level, triggering a massive volume surge and price rejection.

- Bulls mounted defense at $2.23 support during multiple intraday tests and volume spikes.

- Trading activity exploded past 5.92 million during peak selling, well above the 3.42 million baseline average.

- Textbook capitulation emerges with violent selloff followed by immediate relief bounce pattern.

- Volatility compression and price stabilization suggest seller exhaustion may be approaching critical levels.

- Fresh consolidation zone forms around $2.25 following dramatic recovery from intraday massacre.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

source https://www.coindesk.com/markets/2025/10/09/filecoin-drops-as-much-as-7-as-selling-pressure-intensifies

Chainlink's LINK Tumbles 4% as Selling Pressure Mounts

The native token of oracle network Chainlink (LINK) encountered substantial institutional selling pressure over the 24-hour trading session, tumbling to its weakest price in more than a week.

LINK tumbled 4% to a session low of $21.30, reversing over 8% from Monday's local high, CoinDesk data shows. The decline happened in line with weakness in the broader crypto market. The CoinDesk 20 Index, a benchmark for that broader market market, was also down around the same amount.

Meanwhile, the Chainlink Reserve, a facility that purchases tokens on the open market using income from protocol integrations and services, kept its weekly habit, buying another 45,729 LINK worth nearly $1 million on Thursday. The reserve currently holds nearly $10 million worth of tokens.

Thursday's decline, however, meant that the vehicle is now underwater with LINK trading below the average cost basis of $22.44, the dashboard shows.

Key technical indicators

CoinDesk Research's technical model pointed out bearish momentum, underscoring the weakening investor sentiment.

- The token's trading range expanded to $1.05, representing 5% volatility between the session low of $21.53 and peak of $22.68.

- Technical resistance materialized at the $22.68 level, where the token reversed course on exceptionally heavy volume of 1,981,247 units.

- Additional resistance formed at the $21.92 level.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

source https://www.coindesk.com/markets/2025/10/09/chainlink-s-link-tumbles-4-as-selling-pressure-mounts

Wednesday, October 8, 2025

Shayne Coplan Becomes Youngest Self-Made Billionaire After Polymarket's $2B Investment: BBG

Shayne Coplan, founder and CEO of the blockchain-based prediction market Polymarket, has become the world’s youngest self-made billionaire, according to the Bloomberg Billionaires Index.

The milestone follows Intercontinental Exchange (ICE) announcing Tuesday that it would invest as much as $2 billion in the company at an $8 billion pre-money valuation. ICE owns the New York Stock Exchange, one of the world’s most powerful financial institutions.

Coplan, now 27, launched Polymarket in June 2020 after spending a year studying how prediction markets could improve decision-making. The platform lets users wager on real-world outcomes, from elections to sports to economic indicators, using cryptocurrency.

Polymarket’s breakout moment came during the 2024 U.S. presidential election, when users wagered more than $3 billion on potential outcomes. The scale of participation turned Coplan’s idea from a niche crypto experiment into a global phenomenon.

But the rise wasn’t without setbacks. In 2022, Polymarket paid a $1.4 million penalty to settle with the Commodity Futures Trading Commission (CFTC) over allegations it was offering illegal trading. The company said it blocked U.S. users soon after, though regulators later suspected it still hosted American traders. One week after the 2024 election, FBI agents raided Coplan’s apartment. The Justice Department dropped the investigation in July, as did the CFTC's civil investigation.

That same month, Polymarket acquired QCEX, a CFTC-licensed exchange and clearinghouse, giving it legal grounds to operate in the United States. The move marked a sharp turn from its early regulatory troubles to full legitimacy under U.S. law.

Polymarket has since reshaped the gambling and financial forecasting industries. By blending blockchain transparency with the thrill of market-driven prediction, it’s attracting both retail and institutional interest.

Rival platforms have taken notice. Kalshi, another prediction-market operator, began offering bets through a partnership with Robinhood Markets earlier this year.

source https://www.coindesk.com/business/2025/10/08/polymarket-founder-shayne-coplan-becomes-youngest-self-made-billionaire-after-ice-s-usd2b-investment-bbg

Square Launches Bitcoin Payment Tools for Small Businesses

Square, the payment services arm of Block (XYZ), has launched a new set of tools aimed at making bitcoin (BTC) easier to use for small businesses, letting sellers accept crypto payments and manage their digital assets alongside traditional finances, the company announced Wednesday.

The offering, called Square Bitcoin, includes three main features: bitcoin payments, automatic bitcoin conversions from card sales, and a native bitcoin wallet built into Square’s seller platform. Sellers will be able to accept bitcoin with no processing fees for the first year and choose to convert up to 50% of their daily sales into bitcoin automatically. The tools are available to eligible U.S. businesses, with bitcoin payments rolling out November 10.

The announcement reflects a broader trend. Crypto payments in the U.S. are expected to grow 82% between 2024 and 2026, according to data cited in the release. But so far, access to bitcoin has mostly focused on investors or tech-savvy individuals. Square’s move aims to bring that access to Main Street.

In practice, the tools could let a local coffee shop accept a bitcoin payment from a customer using a phone wallet, convert half their day’s sales into bitcoin automatically, and review all their finances in the same dashboard they use to manage inventory and payroll. According to Square, 142 bitcoin have already been accumulated through early use of the conversion feature, first piloted in 2024.

By folding bitcoin into its existing payments and banking ecosystem, Square — a subsidiary of Block (SQ) — is trying to lower the barrier to entry for small businesses to participate in the crypto economy. It’s also a continuation of Block’s long-running focus on bitcoin, which spans retail tools like Cash App and hardware initiatives like its Bitkey wallet and Proto mining products.

Miles Suter, head of bitcoin product at Block, said the tools are designed to help sellers “never miss a sale” while giving them access to financial tools that have typically been out of reach.

“We’re making bitcoin payments as seamless as card payments,” he said in a statement.

source https://www.coindesk.com/business/2025/10/08/square-launches-bitcoin-payment-tools-for-small-businesses-expanding-crypto-access

Tuesday, October 7, 2025

Asia Morning Briefing: Singapore Authorities Say Token2049 Organizer Not Covered by Russia Sanctions After A7A5 Appearance

Good Morning, Asia. Here's what's making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk's Crypto Daybook Americas.

A7A5’s appearance at the recent Token2049 conference wasn’t in contravention of Singaporean law, despite being backed by a sanctioned Russian bank, highlighting the limits of the city-state’s sanctions regime, which applies only to licensed financial firms.

A7A5's ruble-based stablecoin is backed by Russia’s state-owned Promsvyazbank (PSB), an entity sanctioned by the Monetary Authority of Singapore (MAS) as well as financial authorities in the U.S., U.K., and most Western jurisdictions. Bloomberg recently reported that the E.U., as a bloc, is considering sanctions against A7A5 too.

Indeed, an audit prepared for Old Vector LLC, the parent company behind A7A5, warns of possible "redemption and regulatory issues" regarding use of the tokens considering the breadth of the sanctions.

Given A7A5 was a sponsor at Token2049, complete with booths and branded massage rooms, one has to wonder if this contravened Singaporean rules given the exchange of funds.

The answer, according to MAS, is no.

"Singapore financial institutions (FI) are not permitted to facilitate transactions (whether directly or indirectly) for designated persons in contravention of our financial measures," a MAS Spokesperson told CoinDesk in an email. "An entity that is not an FI regulated by the MAS is not subject to the financial measures."

Under Singapore’s sanctions framework, financial measures targeting Russia’s Promsvyazbank and related entities bind banks, insurers, capital-markets intermediaries, and digital payment token providers.

But, according to MAS' own guidance, non-financial companies and individuals are only obligated to comply with United Nations-mandated sanctions, which have never been applied to Russia as the country would veto them as a member of the U.N. security council.

Furthermore, Token2049 is organized by Hong Kong registered BOB Group. Hong Kong, as part of China, does not have any financial sanctions on Russia which makes recieving funds from A7A5 legal in the territory.

Singapore's sanctions are a bit different from what's been imposed in the U.S. where the company behind A7A5 is Specially Designated National (SDN) under U.S. Treasury’s Office of Foreign Assets Control (OFAC) meaning U.S. persons are prohibited from interacting with them in any way.

It may seem like an edge case, but Foundation for Global Political Exchange v. U.S. Treasury shows just how far those restrictions can go.

OFAC initially denied the Foundation for Global Political Exchange, a U.S. nonprofit, permission to host members of Hezbollah – understandably sanctioned individuals – at a forum they organized in Beiruit about peace in the middle east, ruling that simply offering a platform or audience constituted a prohibited service under U.S. sanctions law. Only after a first amendment challenge did OFAC reverse its position, narrowly allowing participation under strict conditions: no payments, no lodging, no coordination, and no affiliation with the event’s host.

By that standard, even in the U.S., hosting A7A5 could be legal if no money or material support changed hands. In Singapore, where sanctions bind financial institutions but not conference organizers, it’s an even easier call. Washington regulates who you can pay; Singapore regulates who can move the money.

Somewhere between those two philosophies – and one Hong Kong crypto wallet – A7A5 found a perfectly legal booth and

💆 Your Neck’s New Best Friend at TOKEN2049

Back-to-back panels? Hours of networking? We’ve got you.

Step into the A7A5 Massage Zone – 110 sqm of pure relaxation on Level 5.

💆 10-minute hand, arm, & neck massages by professional therapists.

🕒 Open throughout event hours

🌿…

Market Movement

BTC: Bitcoin fell to around $122,000, down 3% from record highs, as analysts warned the crypto rally had become overheated following the year’s largest ETF inflows and leveraged positioning, with Deribit projecting a possible pullback to $118,000–$120,000 before another run toward $130,000

ETH: Ethereum is trading around $4,479, down 4.4%, as traders lock in profits following recent gains and rotate out of ETH into other assets, pressuring prices after a strong rally.

Gold: Gold surged past $4,000 for the first time as investors flocked to safe havens amid a weaker dollar, Fed rate cuts, and geopolitical uncertainty, with central banks and retail buyers driving demand; Goldman Sachs lifted its 2026 forecast to $4,900, though Bank of America warned the rally may be overextended.

Nikkei 225: Asia-Pacific markets traded mixed Wednesday, while Japan’s Nikkei 225 hovered around 48,120 — buoyed by optimism over pro-growth policies under new LDP leadership and a tech-fueled global rally, even as concerns about stimulus durability and valuation risks linger.

Elsewhere in Crypto:

- Trump Memecoin Issuer Zanker Is Planning Digital Asset Treasury Company (Bloomberg)

- Gemini stock projected for 25% upside driven by crypto reward card ‘flywheel’ and EU license (The Block)

- CleanCore's Dogecoin Treasury Tops 710M Tokens, Booking $20M+ Gain (CoinDesk)

source https://www.coindesk.com/markets/2025/10/08/asia-morning-briefing-singapore-authorities-say-token2049-organizer-not-covered-by-russia-sanctions-after-a7a5-appearance

SEC Aiming to Formalize 'Innovation Exemption' by End of Year, Chair Atkins Says

NEW YORK — The Securities and Exchange Commission is still looking to formalize an "innovation exemption" for companies to build on digital assets and other innovative technologies in the U.S., potentially as soon as the end of the quarter, said agency Chair Paul Atkins.

While acknowledging that the current government shutdown had "hamstrung" the SEC's ability to make progress on rulemaking, Atkins said working on this exemption is still his priority for the end of the year or the first quarter of 2026, he said at a Futures and Derivatives Law Report event hosted by the law firm Katten Muchin Rosenman LLP in midtown Manhattan on Tuesday.

The SEC chair opened with one of his now-common refrains: That crypto is "job one" and the agency has become a pro-innovation body looking to encourage developers and entrepreneurs to build in the U.S.

"As you know, we've had four years, at least, of repression of that industry, and with the result of pushing things abroad, rather than having innovation being done," Atkins said during a panel with former SEC Commissioner Troy Paredes.

The agency intends to initiate the rulemaking by the end of 2025 or during the first quarter of 2026, he said, depending on what happens with the ongoing U.S. government shutdown.

"We'll see where that goes, but I have confidence [we'll] be able to do it," he said on the panel.

Pursuing formal rulemaking in crypto would finally put the agency beyond the regulation-by-enforcement utilized in the previous administration or the informal guidance and staff notes so far used in this one.

During a Q&A with reporters afterward, he said the exemption, which he pushed for last month, is something he was hoping to have "squared away."

"That's one of the top priorities to try to get that because I want to be welcoming to innovators and have them feel like they can do something here in the United States, so that they don't have to flee to some foreign jurisdiction."

The ongoing government shutdown is hampering the agency's work, Atkins said.

While there are "essential tasks" that the agency can take on, rulemaking — including crypto rulemaking — is paused.

Market structure bill

Atkins praised Congress' work toward passing laws addressing cryptocurrencies during his panel, pointing to the stablecoin-focused GENIUS Act, though he noted that the SEC did not have a major role with that bill.

"Market structure is an issue there on the bill, and so we'll see where that goes," he said. "I'm optimistic."

Speakers at a prior panel were less confident that a market structure bill will make its way out of Congress, at least before 2025 ends.

Summer Mersinger, the CEO of industry lobbyist group Blockchain Association and a former commissioner at the Community Futures Trading Commission, said she gave the bill a 51% or 52% chance of passing this year.

Greg Xethalis, a partner and general counsel at venture firm Multicoin Capital, said lawmakers should be appreciated for their work on the bill, while CoinFund's Chris Perkins said he did not believe the bill would happen.

Stablecoins

The GENIUS Act, the first major crypto-focused bill to become law in the U.S., has started to yield preliminary results, with regulators at the Treasury Department publishing proposed rules for the stablecoin sector earlier this year.

Xethalis said much of what will happen next from a developer front is plumbing.

"Now that we have the rules at Treasury being written for the GENIUS Act, we're going to see a Cambrian explosion of people actually starting to utilize this stuff on a day-to-day basis," he said, pointing to Visa integrating USDC into their payment growth tooling as an example of how people might already be "indirectly us[ing] crypto."

Similarly, Mersinger said stablecoin use could continue to grow, pointing to collateral in fund transfers and other types of financial contracts as a use case.

source https://www.coindesk.com/policy/2025/10/07/sec-aiming-to-formalize-innovation-exemption-by-end-of-year-chair-atkins-says

IREN Declines 6% on $875M Convertible Note Offering

High-performance computing firm IREN (IREN) stock slipped 6% on Tuesday post-market after announcing a $875 million convertible debt offering.

The offering may increase to $1 billion if initial purchasers take up an option to buy an additional $125 million, the press release said. The notes will be unsecured and give holders the right to convert into IREN shares or cash under certain conditions, with maturity set for July 2031.

The firm said proceeds will fund general operations and capped call transactions, which are intended to reduce potential share dilution if the notes convert into equity. These capped calls are also designed to offset potential cash payments if the company's share price climbs significantly. The company added it may seek shareholder approval to repurchase shares to settle those instruments in the future.

The decline nearly erased today's advance on signing new multi-year artificial intelligence (AI) cloud contracts tied to Nvidia Blackwell GPU deployments. Even with the drop, the stock is still up around 1,000% from the April lows as investor appetite for AI-related infrastructure turned feverish.

Read more: Bitcoin Miner IREN Jumps 9% After Securing New Multi-Year AI Cloud Contracts

source https://www.coindesk.com/markets/2025/10/07/iren-declines-6-on-usd875m-convertible-note-offering

Monday, October 6, 2025

Bitcoin Rally Fueled by Perfect Macro Storm; Ether, DOGE, BNB Surge

"Uptober," the wordplay on crypto's historically bullish month of October, is so far living up to its name as bitcoin (BTC) pushed towards new all-time highs and altcoins also caught a bid.

After briefly spiking above $125,000 and retreating on Sunday, BTC followed through on Monday, surging to a fresh record of $126,223 during the U.S. trading session. BTC changed hands around $125,200 recently, up 1.5% over the past 24 hours.

While the dollar's weakness has helped the rally to new highs, the largest crypto now has clinched to new highs in euro terms crossing 106,000 EUR and surpassing its January peak, while breaking its mid-August peak in Swiss franc (99,642 CHF), TradingView data shows.

Bitcoin's strength extended across the crypto market. Ethereum's ether (ETH) advanced 4% to hit $4,700, its strongest price in more than three weeks, leading the broad-market CoinDesk 20 Index higher. Popular memecoin Dogecoin (DOGE) and the native token of layer-1 network BNB (BNB), closely linked to exchange giant Binance, gained 6%-6%.

Crypto stocks posted mixed results on Monday, with retail trading platform Robinhood (HOOD) falling 3% after Galaxy Digital unveiled GalaxyOne, a new crypto trading platform that mirrors Robinhood’s core offering. The announcement sent Galaxy Digital (GLXY) shares up 7%, as investors bet on the firm’s move to compete directly in the crypto brokerage space.

Elsewhere, crypto-linked companies including Coinbase (COIN), Circle (CRCL) and Michael Saylor’s parent company Strategy (MTSR) all closed roughly 2% higher. Their performance aligned with broader gains in the crypto market, where the CoinDesk 20 Index showed most cryptos saw modest upward moves.

The biggest gains came from mining stocks, which surged on news that OpenAI struck a deal to buy tens of billions of dollars worth of AI chips from AMD. The deal could give OpenAI up to a 10% stake in the chipmaker, a move that sent ripples through other AI-exposed sectors.

Marathon Digital (MARA), Riot Platforms (RIOT) and Cleanspark (CLSK) each gained around 10%, driven by optimism around data center demand and possibly boosted further by bitcoin’s rally earlier in the day.

Perfect storm for BTC

Bitcoin's rally is "fueled by a perfect storm of macroeconomic tailwinds," said Jean-David Péquignot, CCO of Deribit, the options trading venue that was recently acquired by Coinbase (COIN).

The U.S. government shutdown is driving debasement trades into perceived hard assets such as gold and BTC, strong inflows into BTC ETFs coupled with dwindling spot supplies on exchanges are feeding a "self-reinforcing bull cycle," he said in a Monday update.

The technicals also point higher, he added, with BTC's double-bottom breakout pointing to short-term targets of $128,000–$130,000, with possible upside to $138,000. However, he also warned of currently overbought conditions, suggesting that a brief shakeout to $118,000–$120,000 remains possible.

"From here, watch for volatility spikes and any shift in put volume as a red flag for near-term corrections," Péquignot said. "Bulls have their eyes on $130K+, and bears might find opportunities in overbought squeezes."

source https://www.coindesk.com/markets/2025/10/06/bitcoin-rally-fueled-by-perfect-macro-storm-ether-doge-bnb-surge

Figure Gets Mixed Wall Street Debut as KBW, BofA Diverge on Outlook

Two major Wall Street investment banks have issued differing views on the newly public fintech firm Figure (FIGR), as the company works to expand its blockchain-based lending and capital markets platform beyond home equity lines of credit.

Keefe, Bruyette & Woods (KBW) initiated coverage of Figure with an “outperform” rating and a 12-month price target of $48.50, suggesting 17.5% upside. The bank praised Figure’s early dominance in tokenized credit markets, where it holds 73% of the private credit segment and 39% of all tokenized real-world assets, according to KBW’s estimates.

Founded by former SoFi CEO Mike Cagney, Figure went public in September and has climbed 12% since its IPO. Its core business tokenizes HELOCs and connects borrowers to investors through a vertically integrated platform that includes loan origination, distribution and a digital asset marketplace.

KBW sees Figure’s tech stack as underutilized and capable of supporting a wider range of credit assets, such as first-lien mortgages and personal loans. It also pointed to upside from products like Figure Exchange and a tokenization tool for third-party assets.

Another broker, Bernstein, earlier initiated coverage on the stock with a more upbeat outlook. It rates Figure as an "outperform" with $54 price target, citing that the firm is doing for lending what stablecoins did for payments, tokenizing traditional assets to make markets faster and more efficient.

Read more: Figure Is a Blockchain Pioneer in Credit Markets, Says Bernstein, Initiating at Outperform

The flipside

Bank of America, however, took a more cautious view.

It initiated coverage with a “neutral” rating and a $41 price target, citing risks around execution, regulation and Figure’s dependence on its HELOC business, which still generates most of its profits and is not yet fully blockchain-native.

BofA sees Figure Connect — a new marketplace that helps lenders match with capital providers — as the company’s next growth driver. The bank expects it to account for 75% of the firm’s total revenue growth between 2024 and 2027.

While both banks acknowledged Figure’s leadership in a neglected corner of consumer lending, they diverged on how easily the company can scale into a broader fintech platform. BofA cited possible roadblocks onboarding large institutions, competition from other tech providers and changing regulatory rules, including updates to the Truth in Lending Act.

The difference in price targets — $48.50 from KBW versus $41 from BofA — reflects the uncertainty surrounding whether Figure’s blockchain infrastructure can transition from a niche use to a more central role in modern finance.

Read more: Blockchain-Based Lender Figure Prices IPO at $25 Per Share, Raising Nearly $788M

source https://www.coindesk.com/markets/2025/10/06/figure-gets-mixed-wall-street-debut-as-kbw-bofa-diverge-on-outlook

Cathie Wood's ARK Bets on Tokenization With a Stake in BlackRock-Backed Securitize

ARK Invest, the asset management firm led by CEO Cathie Wood, is leaning into the tokenization boom by taking a stake in tokenization specialist Securitize as Wall Street races to bring assets onchain.

The ARK Venture Fund (ARKVX), ARK's closed-end, actively managed fund that invests in public and private companies, held 3.25% of its assets in Securitize, making the firm the fund's eighth largest position following artificial intelligence (AI) companies X.AI and Anthropic, according to he fund's latest disclosure dated September 30.

Based on the fund's $325.3 million in net assets under management as of September 30, Ark’s stake in Securitize should be valued at roughly $10 million, according to CoinDesk's calculation.

ARK's investment comes as tokenization emerges as one of the hottest trends in crypto, bringing traditional financial instruments such as bonds, funds and stocks onto blockchain rails. Global banks and asset managers are exploring tokenization to cut settlement times, broaden investor access and keep markets open around the clock.

It's potentially a huge opportunity: the tokenized asset market has grown 112% to $33 billion year-to-date, RWA.xyz data shows, and could swell to $18.9 trillion by 2033, Ripple and BCG projected earlier this year.

Securitize, founded in 2017 and led by CEO Carlos Domingo, is one of the early pioneers of the tokenization space. It issued $4.6 billion in tokenized assets working with traditional finance giants such as BlackRock, Hamilton Lane and Apollo. It is also known as the issuer behind BlackRock's tokenized money market fund, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) that's leading the tokenized U.S. Treasury sector with $2.8 billion in assets.

The firm is also active in equity tokenization, creating on-chain shares of listed wallet provider Exodus in 2022 and entering into an agreement with ether (ETH) treasury firm FG Nexus (FGNX) to introduce its common and preferred stock to the Ethereum blockchain.

Ark's investment follows Securitize's $47 million fundraising round last year, led by BlackRock and Hamilton Lane (HLNE), with ParaFi Capital and Tradeweb Markets (TW) also participating.

source https://www.coindesk.com/business/2025/10/06/cathie-wood-s-ark-bets-on-tokenization-with-a-stake-in-blackrock-backed-securitize

Ex-BlockFi CEO Zac Prince Returns to Crypto Spotlight to Lead Galaxy Digital’s New Banking Platform

Zac Prince, the former chief executive and co-founder of collapsed crypto lender BlockFi Inc., is back in the digital asset industry as the head of Galaxy Digital’s new banking platform, Galaxy One. The move marks Prince’s return to a leadership role less than three years after BlockFi’s bankruptcy, which followed the implosion of crypto exchange FTX.

Galaxy hired Prince earlier this year to oversee Galaxy One, which launched today and allows users to earn yield on cash deposits and trade both cryptocurrencies and traditional equities. The appointment places Prince at the center of another effort to merge crypto services with mainstream finance but this time, under markedly different conditions.

In an interview with Bloomberg, Prince said his personal risk appetite is “more conservative” after what he experienced with BlockFi. He described Galaxy as “night and day in terms of the differences in the setup and the risk appetite and the regulatory structures of the businesses.”

BlockFi became a symbol of crypto’s lending boom and bust. The company drew users by offering interest accounts with returns as high as 9.5%, before collapsing when FTX’s failure left it short of liquidity. In its early days, the company raised funding from the top investment firms, including Peter Thiel’s Valar Ventures as well as Galaxy Digital, which led a hefty $52.5 million round in July 2018.

In 2022, after the collapse of FTX, the U.S. Securities and Exchange Commission charged BlockFi with failing to register its lending product and misleading clients about risks. The firm later settled the case, paying $100 million in penalties.

For Galaxy, led by investor Mike Novogratz, Galaxy One represents an expansion into consumer-focused financial products. The platform’s mix of traditional and digital asset services aims to meet a market that has grown more cautious and more regulated since the excesses of the last crypto cycle.

source https://www.coindesk.com/business/2025/10/06/ex-blockfi-ceo-zac-prince-returns-to-crypto-spotlight-to-lead-galaxy-digital-s-new-banking-platform

Sunday, October 5, 2025

Dogecoin Holds $0.25 Support as Whales Add 30M DOGE Amid 'Ascending Triangle' Pattern

Dogecoin weathered early volatility before settling into a tight band, with institutional flows anchoring support near $0.251. Whales and mid-tier wallets boosted holdings, signaling accumulation as technical patterns compress into an ascending triangle. Traders are now watching if $0.25 can harden into a launch base toward $0.27–$0.30.

News Background

DOGE traded a 5.3% range in the 24 hours to Oct. 6, 03:00, moving between $0.265 and $0.251. The token opened at $0.258, rallied briefly to $0.264, then faded into afternoon selling pressure.

By late session, support held firm in the $0.251–$0.252 zone as buying interest stabilized price near $0.254. On-chain data showed mid-tier wallets added 30M DOGE, lifting their combined holdings to 10.77B tokens, while top 1% addresses now control over 96% of supply.

Price Action Summary

- DOGE swung through a $0.014 corridor, peaking at $0.265 and bottoming at $0.251.

- Afternoon selloff dragged price lower, but $0.251–$0.252 support held on sustained buying.

- Late trading stabilized price at $0.254, hinting at floor formation.

- Final 60 minutes saw a selloff to $0.2540 followed by a modest rebound, with volumes averaging 5.2M and spiking to 33.1M during liquidation.

Technical Analysis

- Key support is anchored at $0.251–$0.252, where buyers repeatedly defended dips. Resistance sits at $0.265, with profit-taking stalling advances.

- The structure reflects tight consolidation inside an ascending triangle, confirmed by accumulation signals.

- On-chain metrics suggest positioning is shifting toward large holders, reinforcing the bullish setup. A decisive move above $0.265 could trigger targets in the $0.27–$0.30 zone.

What Traders Are Watching?

- If $0.25 continues to hold as the structural floor into U.S. hours.

- Whether whales extend accumulation beyond the 30M tokens added this session.

- A breakout attempt above $0.265 to open path toward $0.27–$0.30.

- The impact of concentrated supply (96% with top holders) on volatility around breakout levels.

source https://www.coindesk.com/markets/2025/10/06/dogecoin-holds-usd0-25-support-as-whales-add-30m-doge-amid-ascending-triangle-pattern

XRP Rejected Above $3, Closes Lower as Sellers Dominate

XRP’s early rally into $3.07 met heavy distribution on elevated volume, leaving a high-volume ceiling intact and pulling price back to $2.98. Institutional prints confirmed $3.07 as resistance, while repeated defenses near $2.98 kept losses contained.

News Background

XRP slipped 1% from Oct. 5, 03:00 to Oct. 6, 02:00, retreating from $3.01 to $2.98 despite opening strength.

The token spiked to $3.07 in early hours, only to face concentrated selling pressure.

Analysts said institutional desks were active at resistance, with turnover 17% above daily averages. Despite bearish control through much of the session, XRP ended with a rebound off $2.98, signaling continued accumulation interest.

Price Action Summary

- XRP traded a $0.09 corridor, or 3% intraday range, between $2.98 and $3.07.

- Price peaked at $3.07 before sharp rejection on 64.3M tokens, vs. 54.7M average.

- Selling pressure dragged XRP to $2.98, where support was repeatedly defended.

- A late-session dip triggered a 1.95M-volume flush to $2.979, immediately absorbed by buyers.

- Rebound flows stabilized price near $2.98, with recovery volumes averaging 750K per bar.

Technical Analysis

- Resistance is firmly established at $3.07, validated by above-average selling pressure and repeated failures to break higher. Support holds at $2.98, where buyers consistently stepped in, including a high-volume flush absorbed late in the session.

- Price action reflects a rejection-driven pullback inside a $3.07–$2.98 band. While sellers dominated two-thirds of the session, the defense of $2.98 shows institutions continue to accumulate on dips, keeping the structure intact for another attempt higher.

What Traders Are Watching?

- Whether $2.98 holds as support in coming sessions.

- If $3.07 remains a hard ceiling or weakens under renewed pressure.

- Signs of sustained institutional inflows as ETF catalysts approach.

- Potential test of $3.10 if buyers can reclaim control above $3.03.

source https://www.coindesk.com/markets/2025/10/06/xrp-rejected-above-usd3-closes-lower-as-sellers-dominate

Asia Morning Briefing: Why Russia-Linked Stablecoin Issuer A7A5 Could Exhibit at Token2049 Despite Singapore Sanctions

Good Morning, Asia. Here's what's making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk's Crypto Daybook Americas.